Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Three charts that show the advantage of an active approach to fixed income

Pendal’s head of income strategies AMY XIE PATRICK argued in favour of an active approach to fixed income at this year’s Lonsec Symposium

- Pendal employs AI to analyse “central bank speak”

- Active management matters the most when markets are volatile

- Why bonds, why now? Pendal’s income and fixed interest experts explain

- Browse Pendal’s fixed interest funds

I RECENTLY had the pleasure of participating in a fixed income panel at the Lonsec Symposium.

It was the most engaging panel session I’ve attended in a long time – and if nothing else, it tells me that this asset class has become a hot topic.

In case you weren’t able to attend, here’s a summary of my main observations from the Symposium.

1. What’s better than a rate-cutting cycle for bonds?

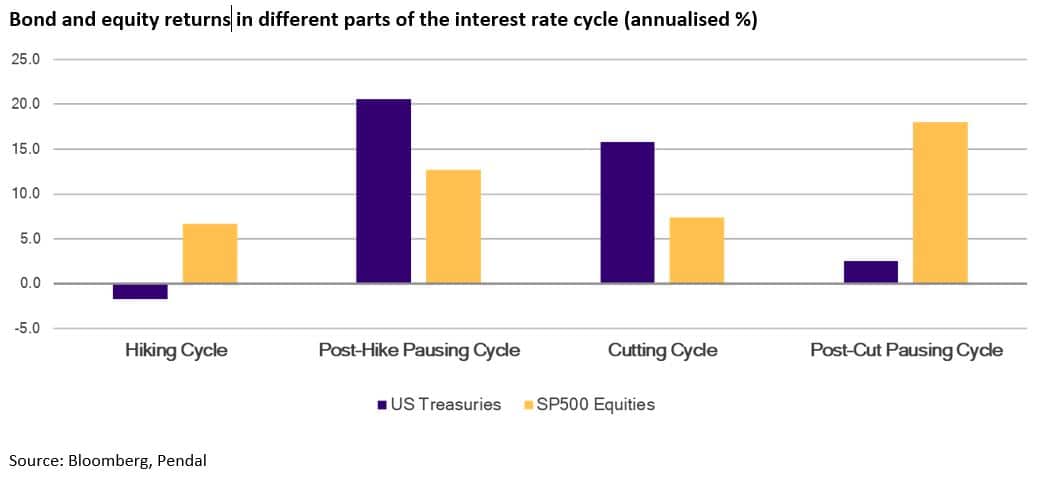

In 2022, the Pendal Income and Fixed Interest team embarked on an exercise to see how bonds and equities performed in different parts of the rate cycle.

The motivation?

Being in the middle of the steepest hiking cycle I’d ever witnessed in my career. I wanted to see just how ugly it could get for bonds.

To do this, we needed to look at data going back as far as the 1970s and the era of hyperinflation.

The results gave us a surprise beyond our original curiosity.

Of course, bonds do well when central banks are slashing interest rates, but it turns out that what’s even better for bonds is when central banks come to the end of hikes.

Opinions are divided about whether cuts will come this year, how many and how soon. On the margin, some debate whether another one or two hikes might be necessary.

This first chart cuts through all that noise – what it tells us is that as long as the conviction has shifted away from hikes, then good times lie ahead for bonds.

2. So, is this the post-hike pause?

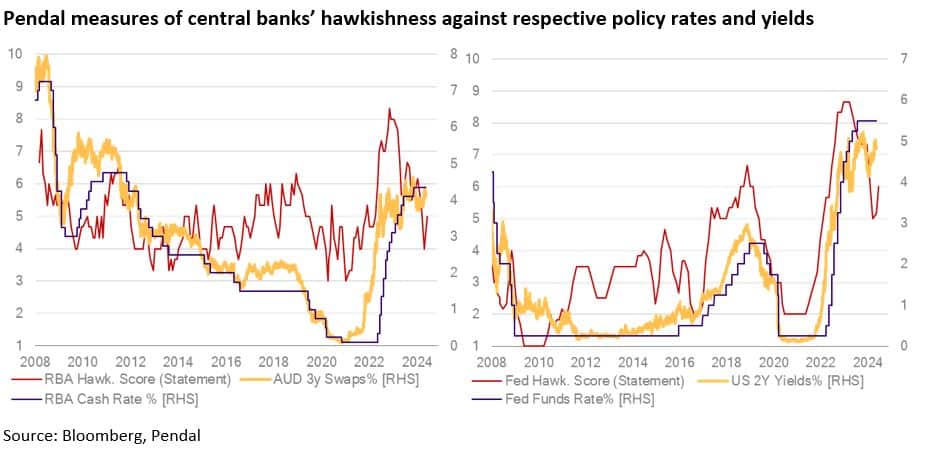

Yes, I think so. But having an objective way to discern how policymakers are leaning is key.

At Pendal, we employ the AI power of large language models to help us decipher “central bank speak” – be it from their statements, minutes or general speeches.

This thinking is not novel, but our methods are unique.

When you do nothing to the raw language coming out of central bankers’ mouths, generative AI tools have a hard time delivering useful results for investors; ten attempts may well lead to ten different answers.

By design, language models prioritise syntax (language) over logic. Our methods look for ways to clean the raw language to make it as straightforward as possible.

The crucial test for whether our measures are useful is the presence of a relationship to local policy rates and yields.

When Pendal’s hawkishness scores peak, policy rates and front-end yields usually peak as well.

What these charts show is that both the RBA and the Federal Reserve have passed their peak hawkishness. Peak policy rates and yields won’t be far away, if not already behind us.

This is most likely the post-hike pause where bonds do their best work.

3. Don’t just close your eyes and buy

Yes, bonds are back. Yes, the time is now. But the road for fixed income has been bumpy.

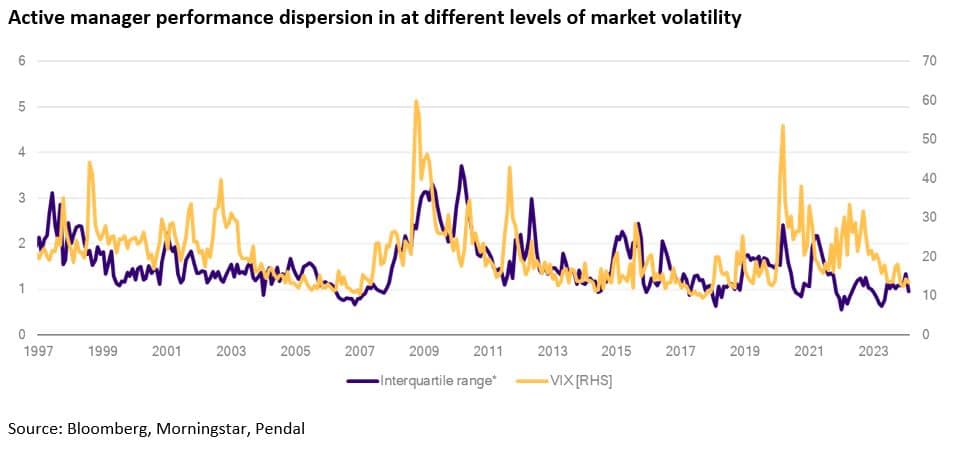

Active management matters the most when markets are volatile.

As the above chart shows, when volatility spikes, the dispersion between active managers’ performance in fixed income really stretches out.

What you can’t see from the chart is that first-quartile managers during the calmer times are rarely able to keep their positions in more volatile times. This makes sense because you need different active tools in different volatility regimes.

Volatility today is about as low as it has ever been in the last three decades.

Now is the time to ensure that not only is your fixed interest exposure allocated to an active manager, but that the managers you choose have what it takes to weather the next spike in volatility.

About Amy Xie Patrick and Pendal’s Income and Fixed Interest team

Amy is Pendal’s Head of Income Strategies. She has extensive experience and expertise in emerging markets, global high yield and investment grade credit and holds an honours degree in economics from Cambridge University.

Pendal’s Income and Fixed Interest boutique is one of the most experienced and well-regarded fixed income teams in Australia. Pendal won the 2023 Sustainable and Responsible Investments (Income) category in the Zenith awards. In 2021 the team won Lonsec’s Active Fixed Income Fund of the Year Award.

The team oversees some $20 billion invested across income, composite, pure alpha, global and Australian government strategies.

Find out more about Pendal’s fixed interest strategies here

About Pendal Group

Pendal is a global investment management business focused on delivering superior investment returns for our clients through active management.

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current at May 21, 2024.

PFSL is the responsible entity and issuer of units in the Pendal Monthly Income Plus Fund (ARSN: 137 707 996) and Pendal Dynamic Income Fund (ARSN: 622 750 734) (Funds). A product disclosure statement (PDS) is available for the Funds and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Funds is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Funds.

An investment in the Funds or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested.

This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.

For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com