Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

The Point

Quick, actionable insights for investors

Responsible Investments

Sustainable fixed interest: How to weigh up WA’s new green bond

Australians invest some $25 billion a year in local green, climate and social impact bonds, according to the Responsible Investment Association’s latest benchmark report.

But only some meet the highest standards of sustainable investors. And it’s not always obvious which ones.

Consider these three examples of recent issuers:

- A national electricity network connecting renewables to the grid

- A telco giant reducing power consumption on its network

- Mining super power Western Australia – the only Australian state that emits more carbon now than it did in 2005

You may be surprised to learn that only the WA bond – announced last week – met with the approval of Pendal’s income and fixed interest team, including ESG credit analyst Murray Ackman.

WA’s green bond “reflects the focus of the government to green up their economy and their energy use,” says Murray.

How to evaluate Australia’s first sovereign green bond

Quick view

How to evaluate Australia’s first sovereign green bond

The federal government last month announced plans for its first ever green bond in 2024.

The bond will offer a return while funding projects – such as hydrogen, batteries and biodiversity – that support a transition to net-zero carbon emissions.

What should investors make of it?

“We’re excited to see the government show interest in green bonds,” says Murray Ackman, credit ESG analyst in our income and fixed interest team.

“But not all green bonds are equal.”

Murray has four main questions that investors should ask when considering the government’s plans:

- Is the bond supporting genuinely new projects?

- Are the projects truly revolutionary?

- Are expectations about reporting clear and transparent?

- Is the green bond connected to a genuine policy commitment to address climate change?

How investors will be affected by changes to a major Australian climate policy

Quick view

How investors will be affected by changes to a major Australian climate policy

The Albanese government’s plan to revamp a Coalition emissions reduction mechanism raise a number of issues for sustainable investors – and the economy.

To help achieve its climate targets, the government plans to revamp a Tony Abbott-era policy known as the “Safeguard Mechanism“.

The policy was designed to reduce carbon emissions by regulating the amount of greenhouse gases that big industrial facilities could emit.

But baselines were too high and the policy generally was not enforced, say critics.

From July, the Albanese government wants to strengthen the mechanism in a number of ways, including a 4.9 per cent annual cut on allowable emissions for the biggest emitters.

The changes could create winners and losers in investment markets, says Pendal credit ESG analyst Murray Ackman.

But the mechanism still has serious challenges.

It uses offsets which can sometimes be questionable, allows new fossil fuel projects and is susceptible to cost-of-living pressures.

How to use ESG to assess state government bonds

Quick view

How to use ESG to assess state government bonds

If you’re investing in state government bonds, you’re probably not too worried about default.

But you might be concerned about a potential credit downgrade – which could result in lower demand for a bond and a drop in its value.

Pendal’s income and fixed interest team has a tool to assess the ESG credentials of state governments – which can highlight credit risks that might lead to ratings downgrades.

The index shows how each state is addressing the UN’s Sustainable Development Goals – a list of the world’s biggest problems.

The ACT, Tasmania and SA lead the index, while WA, Queensland and the NT lag, says Pendal ESG credit analyst Murray Ackman.

“People always talk about default,” says Murray. “But that’s not all we’re looking at.

“There would have to be something catastrophic for a state government not being able to service its debt.

“What does have an impact on your investment is credit downgrades.”

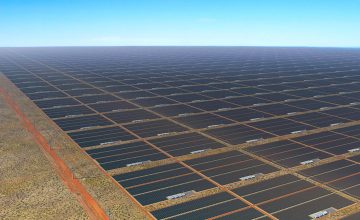

What Sun Cable’s collapse means for renewable investing

Quick view

What Sun Cable’s collapse means for renewable investing

What does the collapse of the ambitious Sun Cable solar project say about investing in renewables?

Backed by Atlassian’s Mike Cannon-Brookes and Fortescue’s Andrew Forrest, Sun Cable had grand plans to supply electricity to Singapore from a vast solar array in the Northern Territory.

But the pair disagreed over the method of export – undersea cable versus green hydrogen and ammonia – and the venture is now in voluntary administration.

“The main takeaway is that Sun Cable collapsed over a dispute about exporting – not over the idea of a huge solar array in the NT,” says Pendal ESG credit analyst Murray Ackman.

But it raises questions about a potential Australian energy export industry and the role of green hydrogen.

“Historically, governments and private entrepreneurs are typically best placed to carry the risk of these types of early-stage innovations,” he says.

“For most investors, it’s too early to be going all in on hydrogen.”

Could polluting companies be forced to pay a climate tax?

Quick view

Could polluting companies be forced to pay a climate tax?

War, floods and China policy changes pushed this year’s COP27 climate change conference off the front pages.

But there was one thing investors should note, says Pendal Credit ESG analyst Murray Ackman.

COP27’s main achievement was an agreement that bigger polluting countries would compensate developing countries for the effects of climate change.

Some are now calling for this same logic to be applied to companies.

“This has obvious implications for investors,” says Murray.

“If the logic is high emitters bear responsibility for mitigating the impacts of climate change, this adds credit risk.”

Take care when investing in sustainability-linked bonds

More companies are issuing “sustainability-linked bonds” — debt securities that pay a coupon linked to environmental or social outcomes.

These bonds typically don’t fund a specific project — instead they set overarching goals such as reducing emissions or improving corporate diversity.

If an issuer fails to hit its goal, usually it pays a penalty in the form of a higher coupon.

Sustainability-linked bond issuance hit US$103 billion globally last year — a yearly increase of 803 per cent, according to World Bank research.

But investors should take care that issuers are genuinely making changes and not simply greenwashing, says Pendal Credit ESG analyst Murray Ackman.

“In theory, they are great — but we’re starting to see some things we are not happy about with these structures.”

How green hydrogen will impact natural gas investors

Quick view

How green hydrogen will impact natural gas investors

The renewable energy transition is increasing the risk of “stranded assets” – such as fossil fuel infrastructure that no longer has an economic use due to redundant technology or high costs.

Green hydrogen is often touted as a potential solution for stranded asset risk in the natural gas industry. Is it really an answer?

“There’s this moon shot that green hydrogen will be a one-for-one replacement for gas,” says Pendal credit ESG analyst Murray Ackman.

The idea is some natural gas pipeline and storage infrastructure could be repurposed for hydrogen.

Hydrogen can even be blended into natural gas – but above 10 or 20 per cent it can damage existing pipes and household appliances would need to be updated.

ESG: What Albo’s 43pc emissions target means for investors

Quick view

ESG: What Albo’s 43pc emissions target means for investors

Energy security and workplace relations were among the biggest ESG themes in the recent ASX reporting season, says Pendal’s Rajinder Singh.

On the labour front, Rajinder says investors should take a look at a company’s agreements with workers.

“If you’ve got an agreement that’s due for renegotiation in the next 12 months versus one that was signed for five years, that could have a material impact on your forecast growth of your labour costs.”

For energy, security of supply is critical, says Rajinder.

“The other thing that matters for investors is understanding the capital expenditure required to address these issues.

“What’s the capital allocation to these initiatives? And is there an actual measurable benefit for the amount they are planning to spend?”

ESG: Fixed interest investors can make the world better too

Quick view

ESG: Fixed interest investors can make the world better too

Sustainable investors should expect fixed interest managers to engage with bond issuers, just as equity managers do with companies, says Pendal credit ESG analyst Murray Ackman.

Engagement refers to dialogue between investors and investees that seeks to improve policies or public disclosure on social, environmental and governance matters.

But it’s not just for equity investors.

Since large parts of the market are unlisted, fixed interest investors are discovering they have a critical role driving change at some of the world’s most important companies.

“Look at the biggest players in the climate transition — most of the utilities, many of the infrastructure owners — they are not listed entities,” says Murray.

“But they issue debt — so we have access to influence them.”

Pendal’s Income and Fixed Interest team has undertaken 73 engagements so far this year.

ESG: Beware the ‘brownium’ penalty

Quick view

ESG: Beware the ‘brownium’ penalty

With high energy prices and oil and gas company revenues soaring, shouldn’t the big fossil fuel companies be outperforming in credit and equity markets?

In a pre-ESG world the answer would be ‘yes’.

But now big fossil fuel-based companies are paying a ‘brownium’ penalty to raise money in fixed interest markets — and are trading on lower earnings multiples in equity markets compared to previous years, says Pendal ESG credit analyst Murray Ackman.

“Bond people don’t tend to like taking as much risk,” says Murray. “And bond investors look at the downside risk of ESG as pretty significant.

“In the bond world, an investor could feel uncomfortable buying some energy bonds and holding them til maturity because the world in seven years or so will be very different.

“What if there’s a sudden policy change that no one saw coming?

“Pricing can be severely affected, and you don’t want to get stuck with a bond that you don’t want until maturity.”

Russia ‘self-sanctions’ are a coming of age for ESG

Quick view

Russia ‘self-sanctions’ are a coming of age for ESG

“Self-sanctioning” of Russia by brands such as McDonalds and Apple shows ESG is now a fundamental aspect of investing says Pendal ESG credit analyst Murray Ackman.

The voluntary sanctions demonstrate that society expects business to step up and take its environmental, social and governance obligations seriously, says Murray.

“Going forward, it’s going to be a lot harder for companies to pick and choose their ESG concerns.

“What’s interesting about Russia is that everyone is being called to account – by their investors, by their customers and by society – and asked to explain their exposure to anything Russian-related.

“This represents a normalisation of ESG.”

Taking an ESG approach to investing will help investors avoid this kind of risk in the future, says Murray.

“How do you predict an invasion? Can you forecast when a war will happen? An ESG approach to investing is basically the only alternative.”

Loading posts...

Loading posts...