Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

The Point

Quick, actionable insights for investors

Responsible Investments

What if zero-Covid fails in China?

Markets haven’t priced in the possibility of a large, uncontrolled Covid outbreak in mainland China, warns Pendal senior credit analyst Terry Yuan.

China is one of the few places pursuing a Covid-zero policy for reasons including vulnerability and political stability argues Terry.

If it suffers a big outbreak, China’s reaction would likely be swift and heavy handed, causing widespread impact on investors including:

– Limited immigration and associated capital flows into Australia and the rest of the world, putting upward pressure on wages, inflation and interest rates

– Delayed bounce-back among Australian travel and immigration companies

– Lockdowns, quarantines and hospitalisations creating bottlenecks in Chinese shipping and production

– Stimulus via fiscal and monetary easing putting pressure on Chinese interest rates

“We’re carefully selecting exposures to companies that have less exposure to China’s zero-Covid policy, but have strong earnings stability, balance sheet strength and sustainability credentials,” says Terry.

What the AGL bid says about the future of energy in Australia

Quick view

What the AGL bid says about the future of energy in Australia

The AGL takeover bid shows businesses exposed to coal face real credit risks as well as decreased demand due to ESG concerns, says Pendal ESG credit analyst Murray Ackman.

AGL, as the country’s biggest carbon emitter, already had a plan to split its coal and renewable assets into separate businesses. But billionaire Mike Cannon-Brookes and his consortium want AGL to more aggressively phase out coal.

In this environment investors need to consider a range of flow-on effects to understand credit risks for investments and asset allocation, says Murray.

“There’s a lot of focus on stranded assets such as coal-fired power plants which won’t be economically viable for their planned lifespan.

“But we’ve also been divesting from coal-adjacent businesses such as coal transportation railways due to fears they won’t be able to generate revenue when coal ends.”

Climate-related transactions and their flow-on effects are now a vital part of credit analysis, says Murray.

Impact investing: Look around for opportunities in the circular economy

Quick view

Impact investing: Look around for opportunities in the circular economy

By now most people know they need to understand the impact of the Net Zero movement on their investments.

Countries including Australia are pressuring companies to help reduce emissions to zero by 2050 – in order to limit a global temperature rise to 1.5°C above pre-industrial levels.

Science shows that’s the level needed to avert the worst impacts of climate change.

But “impact investors” believe many of the activities needed to achieve net zero are also an investing opportunity.

Regnan fund manager Mohsin Ahmad points to companies taking part in the so-called “circular economy”, which aims to transition away from the linear “take, make and dispose” model.

“In terms of getting to Net Zero, energy efficiency and switching to renewables is only going to solve half the problem,” says Mohsin.

“To get the rest of the way, we need to look closely at how we make and use products, and that’s where the circular economy comes in.”

Regnan: Investors are still not getting the ESG disclosures they need

Quick view

Regnan: Investors are still not getting the ESG disclosures they need

It’s been five years since the UN’s Task Force on Climate-related Financial Disclosures began trialling voluntary, consistent climate-related risk disclosures for companies.

Some 80 per cent of global companies are disclosing in line with at least one of the 11 recommended disclosures.

But investors still need to see improvement in ESG-related disclosures, says Alison Ewings, who engages with ASX companies for sustainable leader Regnan.

Regnan research shows disclosures are often narrow in scope and largely ignore system-wide interdependencies and different economic scenarios.

“Companies do a good job of analysing the impacts of climate change on physical locations,” says Alison.

“But it is very rare, for example, to see consideration of the infrastructure on which they also rely on like the transport networks that move things to and from those sites.”

Regnan: ESG engagement must evolve to better protect investors

Quick view

Regnan: ESG engagement must evolve to better protect investors

THESE days it’s a basic expectation that active managers meet regularly with investee companies and issuers to drive behaviour that benefits shareholders and the community.

“Engagement”, as it’s known in the industry, is usually undertaken on a one-to-one basis between an investor and an investee.

For example, sustainable leader Regnan last year engaged with 40 ASX-listed companies, aiming to reduce economic, social and environmental risk to client portfolios.

You can download Regnan’s 2022 engagement report here (PDF).

As ESG increases in complexity it’s becoming clear that engagement must evolve into collaborative, systems-wide activity, says Regnan’s head of engagement Alison Ewings.

“Climate change is a classic example,” says Alison. “You can divest your way out of the risks to a certain point.

“But if left unchecked, climate change will still create risk in portfolios and potential for economic shocks.”

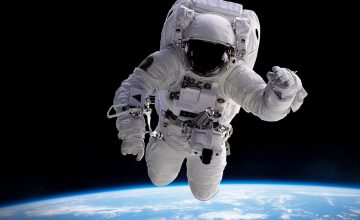

ESG: Why inclusion matters – even for astronauts

Quick view

ESG: Why inclusion matters – even for astronauts

In 2019, NASA planned one small step for women: the first all-female space walk from the International Space Station.

But it didn’t go as planned.

The problem? There weren’t enough medium-sized space suits to go around.

“Truly inclusive decision-making goes beyond the workplace,” says Regnan’s head of engagement Alison Ewings.

“By broadening the approach to consider customers and society at large, you’re more likely to create products and services that meet the needs of a wider range of people.

“We’ve seen personal protective equipment the wrong size for women. We’ve seen machinery that cannot be operated by people under a certain height.

“These are decisions made well before a company discusses how to implement a diversity and inclusion program.”

ESG: Why investors need a new way to engage with companies

Engaging with investees is at the core of sustainable investing.

But the ESG-related issues facing companies are now so complex that investors need another approach, says Regnan’s Alison Ewings.

Company-specific engagement remains important for driving direct outcomes, says Alison, who heads up engagement at sustainable investing leader Regnan.

But many aspects of meaningful change can only come when businesses, not-for-profits, researchers and governments share information and co-ordinate action, she says.

Agriculture is a case in point, with complex sustainability issues across the value chain including climate change, soil health, pollution, water scarcity, food waste and biodiversity and eco-system loss.

“A system-wide approach is going to be required in order to change complex value chains which stretch across our entire economic and social system.”

Regnan last month hosted its first Director Roundtable on Sustainable Agriculture, bringing together senior executives and directors to identify barriers to sustainable agricultural and food production.

ESG: A simple approach to net zero for investors

Quick view

ESG: A simple approach to net zero for investors

Assessing climate risk in a portfolio can be a daunting proposition.

There’s a bewildering array of net zero frameworks, says Alison Ewings, who heads up engagement at sustainable investing leader Regnan.

The Net Zero Asset Managers Initiative, the Paris Aligned Investment Initiative’s Net Zero Investment Framework and the Science Based Target initiative for Financial Institutions are just three.

But understanding the frameworks is not as complicated as it looks, Alison says. There are three activities at the heart of all these protocols, she says:

- Decarbonisation of portfolios and moving away from emissions-intensive activities

- Directly investing in climate solutions that reduce emissions

- Stewardship, ie influencing companies to become Paris-aligned, factor climate considerations into voting and support public policy that addresses climate risk.

“Unless the way you’re approaching net zero is aimed at bringing about meaningful change in the real economy, you’re not actually reducing your long-term risk at all,” says Alison.

Loading posts...