Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Tim Hext: Wage growth remains under control – for now

Pendal’s head of government bond strategies TIM HEXT explains the latest wage data and what it means for rates and bonds

- Why bonds, why now? Pendal’s income and fixed interest experts explain

- Browse Pendal’s fixed interest funds

WAGE growth – a key indicator that the Reserve Bank monitors when weighing up rates decisions – was surprisingly benign in the June quarter.

The Bureau of Statistics published the latest Wage Price Index on Tuesday.

The index, which measures changes in salary across 18 industries, showed overall wages grew by only 0.8% in the period.

We’ve now had three quarters in a row of 0.8%.

This indicates an annual rate of only 3.2%. Though a 1.1% number last September gives us an annual rate of 3.6% with rounding.

More surprising is that public sector wages grew only 0.7% in the quarter.

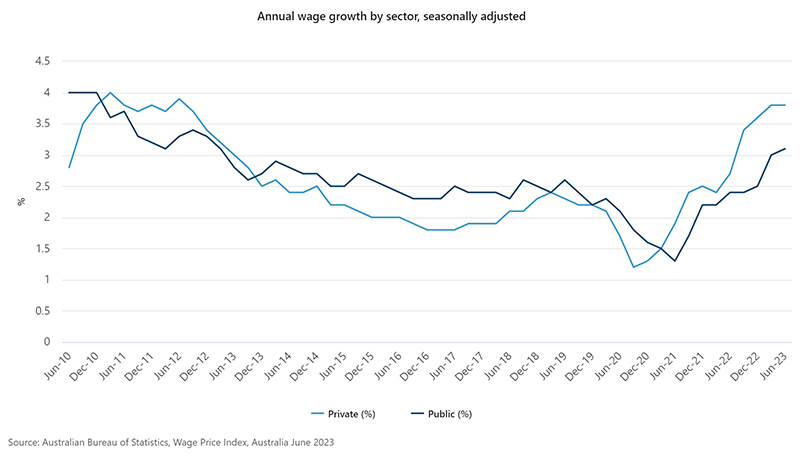

This remains below private sector wages — mostly because three-year agreements in the public sector are slower to respond to changing dynamics.

The opposite was true as wage growth fell across most of the last decade — as you can see in the ABS graph below.

This lower public sector result comes despite a trend for public sector workers to get at least 4% in agreements.

The federal government is now offering 4% next year to unions (and 3.5% and 3% the following years).

Unions have rejected this.

The NSW government has agreed to 4% from July for more than 80,000 workers covered by the Public Service Association.

Teachers and nurses across a number of states have received 4% wage increases over the past 12 months.

Governments offered additional incentives and payments to avoid higher increases given the inflation backdrop.

Wages across the economy are likely to settle on 4% rises for several years yet.

Actual inflation is going to be around 4% and unless unemployment has a very large rise employees will maintain a level of bargaining power.

This 4% is the new 2.5% that we got used to last decade.

GDP data shows a different story

Note that the Wage Price Index is but one measure of renumeration.

Find out about

Pendal’s Income and Fixed Interest funds

It measures salary across 18 industries on a like-for-like jobs basis through time.

It does not account for overtime, bonuses, shifts across industries or the extra 0.5% of super paid each year as we move from 9.5% to 12%.

During strong job markets the index underestimates the total renumeration employees are receiving.

When measuring total compensation of employees we rely on GDP data.

This points to total compensation growing closer to 6%, which partly explains the resilience of the economy.

Since even this data lags by three months, Pendal also tracks data from a number of business liaison surveys to create our own diffusion index.

This currently points to wages being a touch above 4%, in line with the RBA forecast for year end.

What it means for rates and bonds

Overall, the wages number continues to buy the RBA time, with steady cash rates for now.

The market now has a bit less than one hike priced in – and that’s towards year-end or early 2024, so there’s no clear opportunity around mispricing.

Short-ends should remain rangebound for now.

Longer bonds remain vulnerable to higher long-end rates globally.

About Tim Hext and Pendal’s Income & Fixed Interest boutique

Tim Hext is a Pendal portfolio manager and head of government bond strategies in our Income and Fixed Interest team.

Tim has extensive experience in banking, financial markets and funding including senior positions with NSW Treasury Corporation (TCorp), Westpac Treasury, Commonwealth Bank of Australia, Deutsche Bank, Bain & Co and Swiss Bank Corporation.

Pendal’s Income and Fixed Interest boutique is one of the most experienced and well-regarded fixed income teams in Australia.

The team won Lonsec’s Active Fixed Income Fund of the Year award in 2021 and Zenith’s Australian Fixed Interest award in 2020.

Find out more about Pendal’s fixed interest strategies here

About Pendal

Pendal is a global investment management business focused on delivering superior investment returns for our clients through active management.

In 2023, Pendal became part of Perpetual Limited (ASX:PPT), bringing together two of Australia’s most respected active asset management brands to create a global leader in multi-boutique asset management with autonomous, world-class investment capabilities and a growing leadership position in ESG.

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current at August 16, 2023. PFSL is the responsible entity and issuer of units in the Pendal Monthly Income Plus Fund (ARSN: 137 707 996) and Pendal Dynamic Income Fund (ARSN: 622 750 734) (Funds). A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com.

The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested.

This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards.

Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.

For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com