Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Tim Hext: Powell gives the green light after smaller rate rise

Fed chair Jerome Powell today gave the green light to the market’s move to risk-on investing. But it may not last, writes Pendal’s TIM HEXT

JANUARY was a great month for risk. Equities and bonds had strong rallies. Credit spreads contracted.

As we entered February all eyes were on Jerome Powell and the US Fed to see if they would push back on the easing of “financial conditions”.

Here we’re talking about overall financial conditions for the real economy – not just where the Fed Funds rate is.

Financial conditions tries to capture the cost and availability of funding, which impacts spending, saving and investing for businesses and households. Indicators include corporate borrowing rates, US equities and even the US dollar.

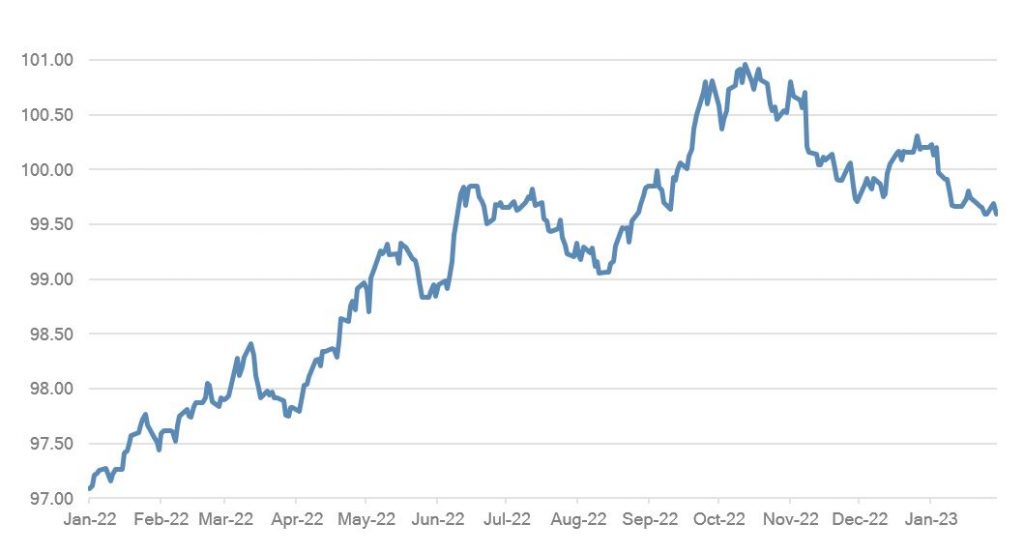

Below you can see the Goldman Sachs US Financial Conditions Index, which suggests it’s becoming cheaper to access money or credit.

The Fed’s response?

This morning the US central bank announced a rate rise of 25 percentage points after a year of bigger hikes.

As always, we look to changes in phrasing in the official Fed statement. Today we saw the phrase “extent of future increases” replace “pace of future increases”.

This is interpreted as the debate shifting from last year’s theme of “25bp, 50bp or even 75bp” to “25bp or nothing”.

The Fed is keeping a few more hikes in its “dot plot”, but it’s now distinctly less hawkish.

All this was not unexpected.

Markets really did not react immediately after the statement.

Rather it was Powell’s press conference that saw equities and bonds get a boost.

The first question asked about the recent easing of financial conditions.

Many would have expected Powell to call this out as unwelcome in the fight against inflation.

He did not.

The Fed, like many central banks caught flat-footed a year ago, is now happy to react to data rather than predict it.

Find out about

Pendal’s Income and Fixed Interest funds

Of course, inflation is a lagging indicator meaning central banks, including the RBA, are happy to sit back and observe these long and variable lags.

Two of the three planks of high US inflation are now in a downtrend. Goods and rents price should ease further in the months ahead and disinflation will be the trend.

However, the third area of services prices remains high. Easing of wages and employment will be need to return to 2 per cent.

Overall though Powell has given the green light to January’s moves to risk-on investing.

February should see that trend continue although at a more modest rate given current levels.

By the middle of the year though, weakness in the economy and falling business margins may see pressures go the other way.

About Tim Hext and Pendal’s Income & Fixed Interest boutique

Tim Hext is a Pendal portfolio manager and head of government bond strategies in our Income and Fixed Interest team.

Tim has extensive experience in banking, financial markets and funding including senior positions with NSW Treasury Corporation (TCorp), Westpac Treasury, Commonwealth Bank of Australia, Deutsche Bank, Bain & Co and Swiss Bank Corporation.

Pendal’s Income and Fixed Interest boutique is one of the most experienced and well-regarded fixed income teams in Australia.

The team won Lonsec’s Active Fixed Income Fund of the Year award in 2021 and Zenith’s Australian Fixed Interest award in 2020.

Find out more about Pendal’s fixed interest strategies here

About Pendal

Pendal is a global investment management business focused on delivering superior investment returns for our clients through active management.

In 2023, Pendal became part of Perpetual Limited (ASX:PPT), bringing together two of Australia’s most respected active asset management brands to create a global leader in multi-boutique asset management with autonomous, world-class investment capabilities and a growing leadership position in ESG.

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current at November 17, 2022. PFSL is the responsible entity and issuer of units in the Pendal Monthly Income Plus Fund (ARSN: 137 707 996) and Pendal Dynamic Income Fund (ARSN: 622 750 734) (Funds). A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com