Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Recession risk is still out there. Here’s why

The risk of recession appears to be sidelined for now, but investors may be overlooking one factor, argues Pendal’s OLIVER GE

- Tightening credit threatens business viability

- Bonds best protection from recession

- Find out about Pendal fixed interest capabilities

A NUMBER of US banks and analysts have walked back their recession predictions in recent weeks.

But there are still worrying signs in the business sector, cautions Pendal’s Oliver Ge.

Much of the discussion about higher interest rates has focused on the impact of bigger mortgage repayments for homeowners.

But tightener credit conditions and stricter collateral requirements for business are likely to have a more significant impact on the economy, argues Ge, an assistant portfolio manager with Pendal’s income and fixed interest team.

“There’s a growing narrative that the economy can navigate through this tightening cycle without derailing growth and causing havoc to the jobs market.

“It can be hard to argue against this. Despite 400 basis points in hikes from the RBA, economic activity remains reasonably robust and domestic employment is incredibly strong.

“But the economic brakes applied via interest rates is very gradual.

“What often gets overlooked is that there is another transmission mechanism — the tightening of lending standards — that carries perhaps more importance to the business cycle.”

As interest rates lift, banks will increase the perceived credit risk of all borrowers. To mitigate these risks they will impose stricter income and collateral requirements on their borrowers.

Small businesses are generally more reliant on bank loans given that they have fewer alternative sources of funding.

“It’s not the cost but access to credit that matters,” says Ge.

“Small business owners rely on a flow of working capital to pay their suppliers and employees. At the moment, the banks are happy to supply that. But should lenders’ outlook on the economy turn, they may have to cut off those lines of credit”.

“That’s when businesses will be forced to pare back on labour and supplies. That spills over into the rest of the ecosystem — that’s when you get that pain.

Tighter lending in the US

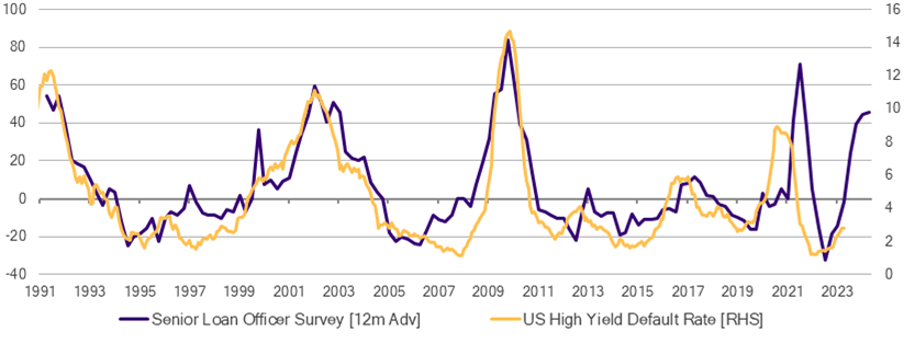

As you can see below, there’s evidence that banks are already tightening lending in the US, where the Federal Reserve conducts a quarterly survey of the biggest banks to assess lending terms.

“Lending standards have tightened significantly, comparable to historic highs,” says Ge.

“Business cash buffers are running out and you’ll likely see a wave of defaults over the course of the next six-to-nine months.

“Ultimately, that is where we’re headed. But it’s not something people are factoring into their forecasts.”

A tightening of lending standards has real potential to push the global economy into recession, says Ge.

“Whatever happens in the US will filter through to the rest of the world. There’s no way that Australians can somehow insulate themselves.

“At the start of the year, people were tossing up between a soft and hard landing. The hard landing scenario has faded from people’s memories.

“But the prospect of recession is still very much out there.”

Find out about

Pendal’s Income and Fixed Interest funds

About Oliver Ge and Pendal’s Income and Fixed Interest boutique

Oliver Ge is an assistant portfolio manager with Pendal’s Income and Fixed Interest (IFI) team.

Oliver works on developing and running key quantitative investment models, and acting as trading support for the team. Oliver received his Bachelor of Commerce (Finance) from the University of Sydney and is also a CFA Charterholder.

Pendal’s IFI boutique is one of the most experienced and well-regarded fixed income teams in Australia. In 2020 the team won the Australian Fixed Interest category in the Zenith awards.

The invests across income, composite, pure alpha, global and Australian government strategies.

Find out more about Pendal’s fixed interest strategies here

About Pendal Group

Pendal is a global investment management business focused on delivering superior investment returns for our clients through active management.

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current at August 23, 2022.

PFSL is the responsible entity and issuer of units in the Pendal Monthly Income Plus Fund (ARSN: 137 707 996) and Pendal Dynamic Income Fund (ARSN: 622 750 734) (Funds). A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com.

The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund.

An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested.

This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.

For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com