Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Amy Xie Patrick: A fixed-income perspective on current market volatility

Pendal’s head of income strategies, AMY XIE PATRICK, explains what the recent market volatility means for fixed-income investors

- Trending ‘unwinds’ contributing to risk-off sentiment

- Volatility expected to stabilise and then fall

- Why bonds, why now? Pendal’s income and fixed interest experts explain

- Browse Pendal’s fixed interest funds

BIG market moves have rocked sentiment since the beginning of August.

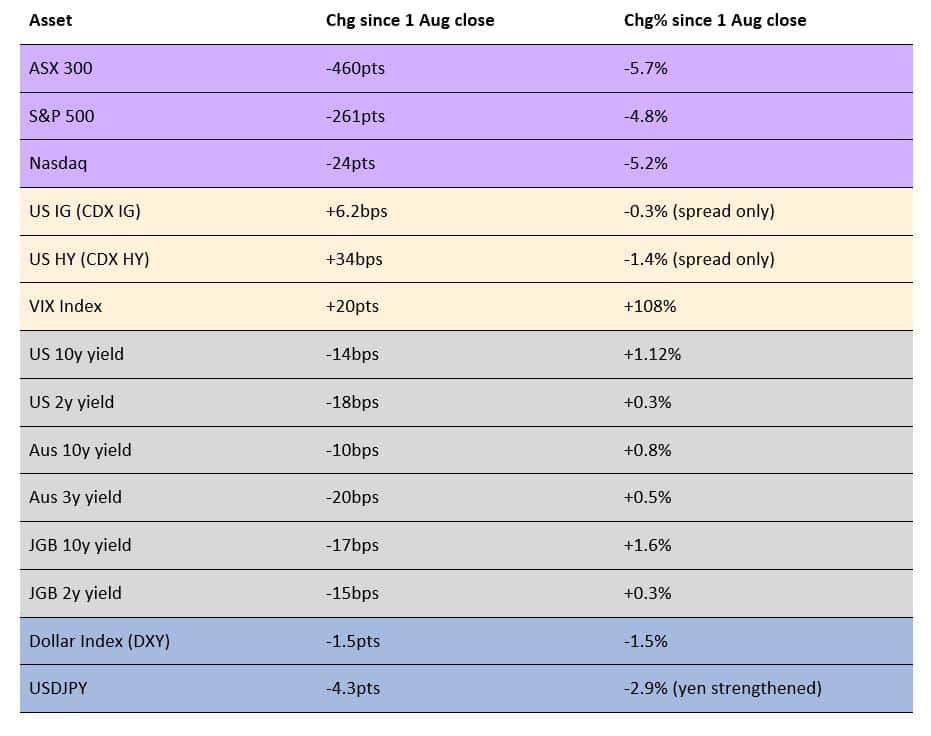

The table below shows market moves in equities, credit, volatility and bonds since August 1.

These are classic “risk-off” moves.

Figure 1: Risk off!

Major benchmark moves since market close on Thursday 1 August 2024

Whiplash

For bond investors, it’s not so much the fall in yields that was interesting to witness in the price action of the past few market sessions. It’s the fact they rebounded significantly from the lows seen on Monday, August 5.

US 10-year yields, for example, backed up 19bps from Monday’s session lows and US two-year yields rebounded by more than 30bps.

Perhaps the market remembers the whiplash from early 2024.

Rate markets rushed to over-interpret the Fed’s end to hiking as the start of the next concerted easing cycle. But they were disappointed by an overt “wait-and-see” stance from Fed officials.

In Australia, our markets priced in four rate cuts from the RBA earlier this year, but had to swiftly walk that back when resilient economic and sticky inflation data failed to support those hopes.

Only a few weeks ago, Australian short-end rate markets were pricing in a 50 per cent chance of the August RBA meeting raising the overnight cash rate a further 0.25% to 4.60%.

Following a more benign-than-feared June CPI release, the meeting ended with another hold decision — and an RBA that still “rules nothing in or out”.

Is this an emergency?

In the US, market pricing currently sees a 100% chance of a 0.50% cut in September, followed by consecutive 0.25% cuts in subsequent Federal Open Market Committee meetings.

The argument seems to be that had the Fed seen the full suite of July data at its end-of-July meeting, the central bank would have opted to cut.

On top of this, some big-bank economists are now calling for back-to-back 0.50% cuts – even an inter-meeting emergency cut.

Are things really dire enough to justify a panic to easing?

We argue the data isn’t there yet.

The US labour market report was the main cause of the market’s negative reaction on August 2.

The gain in employment fell well short of market expectations. Unemployment rose from 4.1% to 4.3% while the market anticipated no change.

Employment gains, however, were still gains.

Coupled with a slight fall in average hourly earnings, this is the kind of data that would have had bond and equity markets partying a couple of months ago.

Monday night’s release of a healthier-than-expected set of ISM Services data pointed to no evidence that a recession is waiting on our doorstep.

Similarly, second-quarter earnings season in the US so far shows an earnings beat of 5.2% versus analyst expectations.

This puts total earnings growth from the companies that have reported so far at over 11%.

In recessions, earnings typically fall by 10% or more – so the corporate picture also doesn’t have the US in a recession. Yet.

Various unwinds

A bigger reason for the risk-off market sentiment could be a combination of recent events:

- A “great rotation” away from expensive tech to less expensive small caps, as investors become sceptical that AI-related hype can meet with real results

- The “yen-unwind”, as the Bank of Japan starts to remove the cheapness of yen funding from international carry and risk-seeing trades

- The “great de-grossing”, as risk-parity funds rush to reduce exposures as volatility rises.

By themselves, these trends naturally run out of energy.

The rotation into small caps should end because 40 per cent of Russell 2000 companies are not profitable.

Carry trades should unwind when the excesses in their momentum to the upside have been unwound.

And the risk-shedding of risk-parity funds will end so long as there are not marginally incremental waves of risk-shedding.

Volatility should stabilise, then fall.

Watch the economy

We think fundamentals or a systemic shock are needed to ignite the next recession. Unfortunately, there are a few fundamental developments to worry about.

Over the next year, analyst earnings expectations for the S&P 500 have growth at more than 10% per quarter. That’s not to say it can’t happen — but not even a soft landing seems to be baked in there.

Default rates have continued to climb among US corporates, but even including the moves of the past week, credit spreads are near their cycle lows.

The New York Fed’s recession probability index has climbed to new cycle highs. We know that after a lag, the VIX Index (a gauge of market volatility) also follows.

Vacancy rates in US office real estate have continued to rise and now sit at over 20 per cent. As a result, delinquency rates in US commercial real estate are climbing.

Not just yet

The conclusion of our analysis is that it’s not quite “the big one” just yet.

Following big positive runs in bonds, we need to take a calm breath and ask whether the fundamentals justify the pricing of emergency cuts.

If not, profit-taking comes first. Waiting for the next opportunity to buy bonds comes next.

Zooming out, we’re in the ripe part of the cycle for owning some bonds in portfolios, regardless of your stance on risky assets.

Without a recession, bond yields should continue to fall steadily as central banks around the world normalise their policy settings from restrictive levels.

Some have more work to do than others. Many have already started the journey. That’s because we won’t be talking about inflation as a problem for much longer.

With a recession, bonds will pay for themselves.

Bonds are not guaranteed to perform all the way to the end of a recession, but they’ve always been useful at the start of recessions.

Since the start of recessions are hard to predict, bonds provide great insurance for the unpredictable.

Add to that the 4% types of annual income returns you can currently get on US or Australian 10-year bonds and it basically amounts to being paid to take out insurance.

That’s a nice change from the insurance inflation we’ve all been experiencing for the past two years.

About Amy Xie Patrick and Pendal’s Income and Fixed Interest team

Amy is Pendal’s Head of Income Strategies. She has extensive experience and expertise in emerging markets, global high yield and investment grade credit and holds an honours degree in economics from Cambridge University.

Pendal’s Income and Fixed Interest boutique is one of the most experienced and well-regarded fixed income teams in Australia. Pendal won the 2023 Sustainable and Responsible Investments (Income) category in the Zenith awards. In 2021 the team won Lonsec’s Active Fixed Income Fund of the Year Award.

The team oversees some $20 billion invested across income, composite, pure alpha, global and Australian government strategies.

Find out more about Pendal’s fixed interest strategies here

About Pendal Group

Pendal is a global investment management business focused on delivering superior investment returns for our clients through active management.

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current at August 7, 2024.

PFSL is the responsible entity and issuer of units in the Pendal Monthly Income Plus Fund (ARSN: 137 707 996) and Pendal Dynamic Income Fund (ARSN: 622 750 734) (Funds). A product disclosure statement (PDS) is available for the Funds and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Funds is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Funds.

An investment in the Funds or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested.

This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.

For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com