Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Fixed Interest wrap: Our views on latest inflation data, the RBA review and YFYS reforms

It’s been a busy time for fixed-interest investors. In this bumper edition, our head of government bond strategies TIM HEXT outlines his views on the latest inflation data, the RBA review and YFYS reforms

FIRST to the latest Australian inflation data for the March quarter.

Since the introduction of monthly inflation data we know about 70 per cent of the quarterly story ahead of time – and the latest data came in largely as expected.

Headline inflation was 1.4% (7% annual). Underlying, or trimmed mean inflation (the RBA’s preferred measure) was 1.2% (6.6% annual).

Inflation remained strong in housing at 1.9% for the quarter, though that was boosted by gas prices up 14%.

Health was strong at 3.8% led by pharmaceutical products and medical and hospital services.

Education was high at 5.3% for the quarter, but it is only measured annually in February.

Finally, insurance was up 1.9%.

This all led to non-tradable (ie services) inflation at 1.9%, not far off the 2.1% from last quarter.

The domestic economy is not really relenting.

Goods prices continued their fall to 7.6% as supply chains return to normal. Tradables inflation was just 0.3% for the quarter.

This week’s quarterly data showed goods inflation almost flat-lining as supply chains return to normal, while services inflation jumped to 6.1%.

Given it’s a one-third / two-thirds split between goods and services, this leaves the medium-term annual inflation pulse nearer 4%.

No more hikes, but don’t expect cuts

The RBA will be encouraged that inflation is falling. Their 4.75% forecast for 2023 looks too high and will likely be revised down in May.

This means no more rate hikes, with the fixed-rate cliff doing the work on the domestic economy for the rest of 2023.

However, those looking for rate cuts late this year or early next year will be disappointed.

The easier work on inflation is done.

The harder work of reining in services inflation and the domestic economy is very much a work in progress.

It will not be smooth or pretty and will require rates stuck at this level for the rest of this year.

Overall the latest data supports our duration-friendly view on markets, but as always levels will determine our risk.

Find out about

Pendal’s Income and Fixed Interest funds

The RBA Review

Plenty was written about the RBA review last week. Most recommendations look reasonable and a review was definitely overdue.

But two things stood out to me about the report and its recommendations:

1. What about fiscal policy?

The report perpetuated the view that monetary policy is more important than fiscal policy

Most people still think monetary policy — not fiscal — is the most important lever in controlling inflation and activity.

They have elevated central banks, often with the help of central banks themselves, to a level of impact that just isn’t true.

Reading the dissection of RBA actions since 2016 must have been painful for Governor Phil Lowe, who I suspect — after being painted as the main culprit — wanted to cry out “but what about fiscal policy!”.

In fairness fiscal policy was not the focus of the report. It does occasionally reference fiscal policy, but when mentioned it’s given second billing.

From the section of the report dissecting events in the low inflation period of 2016-2019:

Some people consulted by the Review pointed to fiscal policy and the role it was playing in Australia.

During this period, fiscal consolidation weighed more heavily on domestic demand than the RBA had expected.

Prior to the outbreak of the COVID-19 pandemic, the 2019–20 Budget projected a balanced fiscal position for the financial year. At the same time, the cash rate was at historic lows.

The review heard from some that fiscal settings should have been looser to assist monetary policy to bring inflation closer to its target and boost employment.

This is quite soft language.

In reality it was absurd to try to balance the budget as some sort of fiscal bravado when there was clearly excess capacity in the economy and inflation wasn’t a problem.

From the section on the overshoot in inflation since 2021:

For example, while the Review (and many consulted by the Review) considers the strong and rapid fiscal and monetary policy response at the onset of the pandemic to be appropriate given the threat to lives and livelihoods, the cumulative effects of the measures over time contributed to the overshoot of inflation in Australia.

Indeed, Murphy (2022) found that, combined, the fiscal and monetary stimulus added 3.0 percentage points to inflation during 2022.

Of this, 0.6 percentage points were attributable to monetary policy being more accommodative than would normally be the case given prevailing economic conditions.

This suggests 80% of the overshoot problem was fiscal not monetary. Yet reading the report you’d think the opposite.

Maybe a major inquiry into fiscal actions through Covid should follow the RBA report.

Ultimately it would be more important for future episodes of massive disruption.

The report does reference closer coordination between fiscal and monetary policy but actual actions were outside its remit. It should not sit outside of the remit of those who pursue efficient public policy.

2. “Give me a one-handed Economist. All my economists say ‘on one hand…’, then ‘but on the other…” — President Harry Truman

Monetary policy will be more volatile, not less.

Will decisions be wiser under the new RBA plan? Policy is an art not a science.

A separate monetary policy board, and likely more pressure to return to targets sooner, will lead to more rate volatility. There is likely to be less patience on over-shooting or under-shooting targets.

Inflation has spent more time outside the 2-3% range than inside since the target was introduced in 1993. Yet the average is almost exactly 2.5%.

Ultimately, the RBA has been generally correct in its patience.

The RBA will now only have two of nine votes on cash rates (three if the Treasury Secretary is included).

This would not be welcomed by the RBA, despite a brave face.

I suspect the governor will work behind the scenes to persuade voting members of the RBA view prior to a vote.

But the independent members — who will love having a seat at the most important economics table in town — are not there to rubber stamp.

Encouraged to be opinionated, they will not always play ball with the RBA view.

The report celebrates a diversity of views, believing “a stronger culture of constructive challenge and openness to diverse views” is vital.

This sounds good and is important. But as anyone who has been in a decision-making seat before will testify, democracy has its challenges.

Unfortunately, we will not see why the dissenters dissented. Only the vote, not the reasons, will be disclosed.

The votes also will not be attributed, leaving us guessing, at least in the short term.

The report also does not go back 30 years to analyse the times the market got it very wrong. Let’s face it, the independent board members will often be heavily influenced by markets and the media’s running commentary.

As someone who has been making market calls for more than 30 years, I am perhaps more honest (and dare I say humble?) than many commentators.

Remember 2011 to 2014?

Markets were very slow and sceptical on RBA rate cuts, believing inflation was still a post-GFC problem when central banks didn’t.

I suspect among the six independents the market’s view would have found some favour and made the appropriate cuts less likely.

What about 2008?

Despite worsening global problems the market had hikes, not cuts, priced in right up to June 2008.

The only major episodes I can think of where markets were right and central banks were asleep at the wheel is 1994 and 2021.

Unfortunately for the RBA there is a massive recency bias.

Benchmark Reform for Your Future Your Super (YFYS)

Earlier this month Australian Treasury released a draft report for benchmark reform under Your Future Your Super (YFYS).

The benchmarks are extremely important as the performance measure for MySuper products when conducting tests.

As 13 of the 76 MySuper products discovered in 2021, underperformance against benchmark of more than 0.5% for two years in a row could be catastrophic, as new flows are halted.

Therefore when reforms are suggested to fixed income benchmarks were are very interested, since it’ss safe to assume MySuper products will adjust holdings to more closely match the new benchmark.

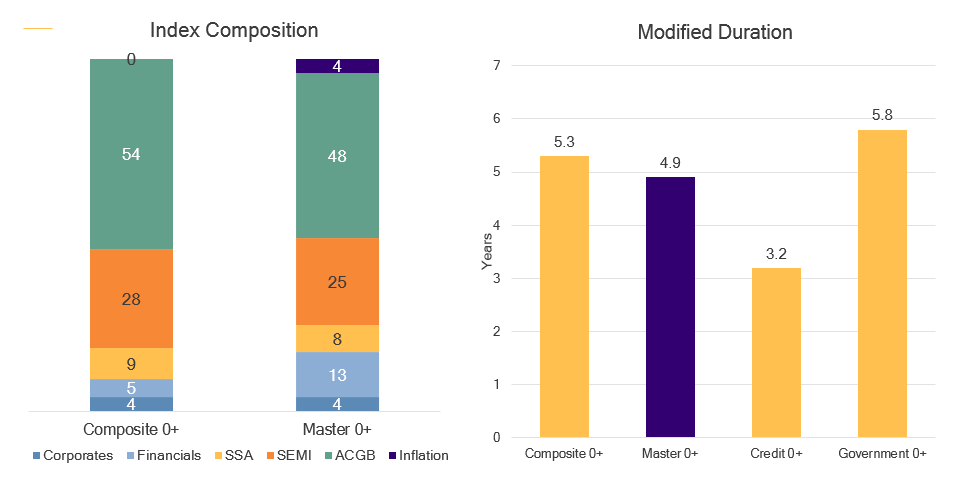

Among many proposed changes across asset classes, there is a change in the default Australian fixed income benchmark from the Bloomberg Ausbond Composite 0+ Index to the Bloomberg Ausbond Master 0+ Index.

The difference is that the Master Index includes everything in the composite plus inflation bonds and credit Floating Rate Notes (FRNs).

This increases the outstanding universe from $1.4 trillion to $1.65 trillion as $60 billion of inflation bonds and almost $200bn of credit FRNs are included

You can see a summary of the differences below:

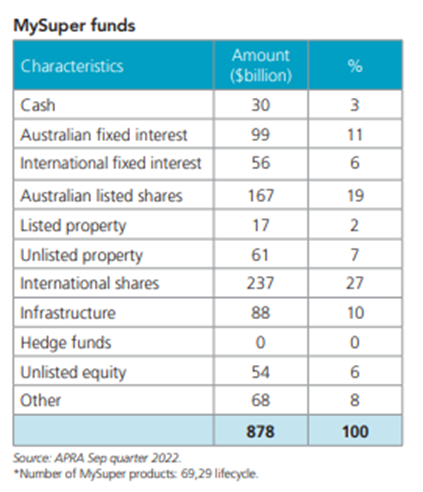

It’s estimated that more than $900 billion of Australia’s $3 trillion of super money is invested in MySuper products.

Some 60% of all super accounts are in these products. The majority sit in industry funds, but retail funds are also big providers.

Data from the Australian Super Funds Association (see below) suggests as of late last year almost $100 billion sat in Australian fixed interest, consistent with a 10-15% allocation.

Of course there are also non-MySuper products that reference the Composite Bond Index, which may seek to match the change or are indirectly captured by YFYS.

The Composite bond index spent its first 20 years, after starting in 1989, as roughly 70 per cent government and 30 per cent credit.

A massive government issuance since the GFC (and now Covid) has seen credit diluted down to 17%, of which supranationals are over half.

Introducing more Australian credit vias FRNs will see genuine credit (non-supras) almost double from 9% to 17%.

Inflation should also have a home in default products.

It could be argued that protecting purchasing power should be the first requirement of any investment, so 4% of the Master Index is far too low in my view.

However, at least it is a start in the right direction.

Market Impact of YFYS reforms

The YFYS changes are likely to be introduced in August, though fund providers will likely seek to adjust prior to that date, possibly from July 1.

We must also recognise that part of the reason for the proposed change is that some funds already have holdings closer to the new benchmark than the old.

Holding some inflation and credit FRNs and topping up duration with derivatives (mainly government bond futures) is a smart and commonplace strategy.

Ultimately, investors benefit from this.

Though the performance test has never been about optimal portfolios, but rather performance against benchmark. This will reduce tracking error for many funds.

There will still need to be some important changes.

The reduction of 0.4 years of duration is very large.

This may be worth around 15-20 basis points if we use the recent large index lengthening (March 31) of 0.2 years as a guide.

We can also reference the recent $14 billion AOFM 2034 issue that cheapened the market by around 10 basis points.

Demand for credit FRNs, which are predominately Australian banks, should be strong.

Fortunately, as the Term Funding Facility unwinds, banks will have plenty of issuance to do. This will still provide a decent tailwind for bank spreads.

Finally, inflation should see net demand.

For a small and at times challenged liquidity market — where $150m tenders can move the market 5 basis points — any large shifts will have a decent impact.

Physical inflation bonds have always enjoyed a decent discount to Inflation Zero Coupon Swaps (ZCS), since ZCS has been the favoured inflation hedge of super funds so they can deploy capital elsewhere.

This discount should narrow quite quickly and we recommend funds invest in physical bonds until the gap is closed.

Conclusion

We are increasingly factoring these changes in to our investment decision-making in the next few months.

We are also keen to hear from investors whether there is appetite for a fixed income product or unit trust based off the Master index.

We do not currently plan to change the benchmark of our two flagship funds (Pendal Fixed Interest and Sustainable Australian Fixed Interest) but look forward to an active dialogue with investors if their needs change.

About Tim Hext and Pendal’s Income & Fixed Interest boutique

Tim Hext is a Pendal portfolio manager and head of government bond strategies in our Income and Fixed Interest team.

Tim has extensive experience in banking, financial markets and funding including senior positions with NSW Treasury Corporation (TCorp), Westpac Treasury, Commonwealth Bank of Australia, Deutsche Bank, Bain & Co and Swiss Bank Corporation.

Pendal’s Income and Fixed Interest boutique is one of the most experienced and well-regarded fixed income teams in Australia.

The team won Lonsec’s Active Fixed Income Fund of the Year award in 2021 and Zenith’s Australian Fixed Interest award in 2020.

Find out more about Pendal’s fixed interest strategies here

About Pendal

Pendal is a global investment management business focused on delivering superior investment returns for our clients through active management.

In 2023, Pendal became part of Perpetual Limited (ASX:PPT), bringing together two of Australia’s most respected active asset management brands to create a global leader in multi-boutique asset management with autonomous, world-class investment capabilities and a growing leadership position in ESG.

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current at April 26, 2023. PFSL is the responsible entity and issuer of units in the Pendal Monthly Income Plus Fund (ARSN: 137 707 996) and Pendal Dynamic Income Fund (ARSN: 622 750 734) (Funds). A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com