Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Emerging Markets: Take care with Asian tech leaders such as Korea and Taiwan

Pendal’s JAMES SYME warns investors to take care before jumping into South Korea or Taiwan on the back of bullish semi-conductor export expectations

- Taiwan, South Korea exports historically weak

- Look instead to the likes of Mexico

- Find out about Pendal Global Emerging Markets Opportunities fund

EMERGING MARKETS investors will be aware that media and analysts have recently been weighing up the prospects of a return to growth for key Asian tech hardware export markets.

But Pendal’s James Syme warns investors to take care before jumping into South Korea and Taiwan on the back of bullish semi-conductor export expectations.

Expectations that South Korea and Taiwan can lead an emerging markets recovery are overdone as both countries continue to face historically weak conditions in their key semi-conductor and electronics export industries, argues Syme.

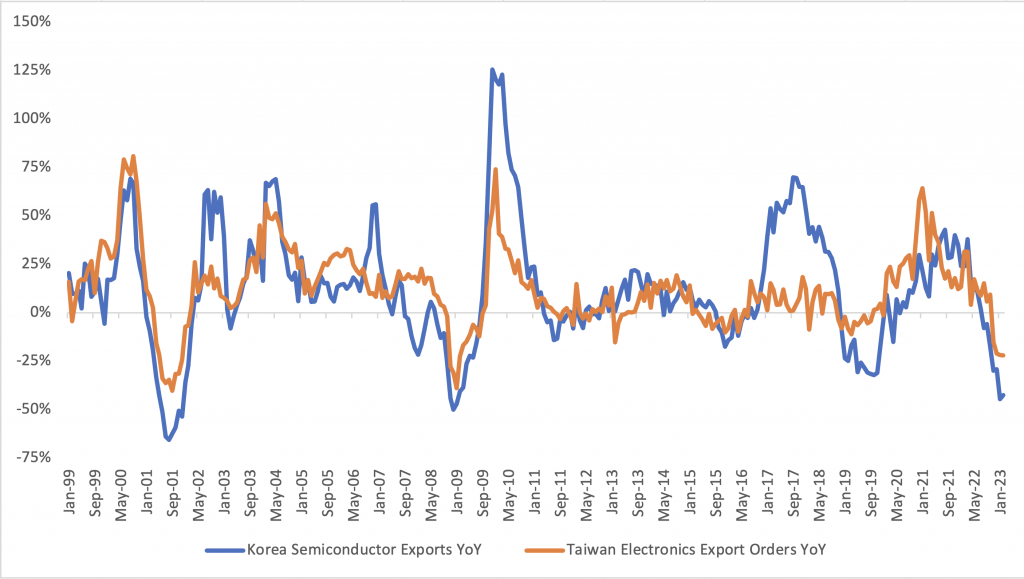

An analysis of economic conditions and export data shows little evidence of recovery, with some key metrics as weak as they were during past global recessions like the tech wreck of 2001 and the financial crisis of 2008.

“We’ve seen a lot of a lot of investors go back to the playbook of what worked for the last couple of years — Chinese Internet stocks and Korean and Taiwanese tech hardware names,” says Syme, who co-manages Pendal Global Emerging Markets Opportunities Fund.

“But when we look at the data, we see no evidence of that at all.”

South Korean exports of semiconductors were down 42.5 per cent year on year in February. Taiwanese electronics exports fell 22 per cent for the same period.

“We’ve only seen those levels in 2008, 2001 and in 1990,” says Syme.

Find out about

Pendal Global Emerging Markets Opportunities Fund

“It may or may not be the case that the global economy is tipped into recession by Fed interest rate hikes — but looking at the current state of the tech hardware industry, it looks and feels like there’s a major recession.

“It might be that we’re seeing the tail end of a drop off in the developed world before China recovers, but our process is based on looking at what’s happening, not imagining what might happen — and when we look at what’s happening, things are difficult.”

Syme says one key indicator — the number of days of inventory in the global semi-conductor industry — has “exploded higher, even to way above where it was in the bad days of ‘08”. That implies reduced demand while this inventory bulge is worked through.

Economic data from South Korea and Taiwan are important indicators of the state of the world economy. Both countries publish a good amount of data with long time series, which can be used as a benchmark for global demand.

South Korea is a major exporter of cars, machinery and steel. Taiwan is a leading exporter of semiconductors and electronics.

Overall exports for South Korea were down 7.5 per cent in the year to February, while Taiwan’s exports fell 17 per cent over the same timeframe.

Exports are not the only indicator of tough economic times.

Purchasing manager surveys in both countries show expectations of contraction. Korean industrial production in January showed a disappointing 12.7 per cent contraction, while Taiwan’s industrial production fell 10 per cent in February to be down 21 per cent year on year.

“It’s just a really weak set of data,” says Syme.

“Now, things could recover from here, but a lot of the mood around technology right now looks difficult.

“There’s a bit of hope that Artificial Intelligence products like ChatGPT will lead to demand for server hardware.

“But if you look at the start-up ecosystem, if you look at demand for tech hardware for crypto mining, and if you look at job moves from the global scale players like Amazon, Microsoft, Google and Netflix, it looks really difficult.”

Syme says earnings expectations for South Korea and Taiwan are now trending down after being some of the best-performing earnings markets during COVID.

“Despite a recovery in China and ongoing growth in other major economies like India or Indonesia, we think it’s far too soon to be looking for Taiwan and Korea to lead.”

Look to the likes of Mexico

Instead, Syme says investors should stick to the emerging markets that are suited to current global economic conditions.

“Mexico continues to deliver in terms of exports and remittances. And Poland, Hungary and Czech are looking a lot better than a year ago.

“So, you wouldn’t say that it’s all red lights in terms of the outlook for the global economy — it’s sector specific.

“There’s an enormous shortage of people in the United States who are able and willing to drive trucks and serve food and clean and build things — that it is an enormous opportunity for Mexico, which is a supplier of people who can do that.

“The developed world has a shortage of labour — but there’s no shortage of DRAM or NAND flash or CPUs or GPUs.”

About Pendal Global Emerging Markets Opportunities Fund

James Syme, Paul Wimborne and Ada Chan are co-managers of Pendal’s Global Emerging Markets Opportunities Fund.

The fund aims to add value through a combination of country allocation and individual stock selection.

The country allocation process is based on analysis of a country’s economic growth, monetary policy, market liquidity, currency, governance/politics and equity market valuation.

The stock selection process focuses on buying quality growth stocks at attractive valuations.

Find out more about Pendal Global Emerging Markets Opportunities Fund here

Pendal is a global investment management business focused on delivering superior investment returns for our clients through active management.

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at April 26, 2023. PFSL is the responsible entity and issuer of units in the Pendal Global Emerging Markets Opportunities Fund (Fund) ARSN: 159 605 811. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com