Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Budget 2023: Stage 3 tax cuts remain centre stage

There wasn’t much to move markets in the 2023 federal Budget, leaving next year’s stage 3 tax cuts as the main discussion point, says our head of bond strategies TIM HEXT

OVER the 2022-23 tax year, the government has drained ever so slightly more money (revenue) from the economy than it injected (spending).

That’s resulted in a forecast $4 billion surplus in this week’s federal Budget.

In other words, the government has neither added nor taken away from economic activity.

How has this improvement happened?

About half of the improvement from original forecasts is old-fashioned bracket creep and increased employment.

That is, we the workers are paying more.

The other half comes courtesy of the corporate sector: directly through higher commodity production and prices, but also through higher general corporate earnings.

Last time this happened, pre-GFC, we ended up with the Future Fund (helped also by the sale of Telstra).

In fairness to this government though, then prime-minister John Howard didn’t take over from a pandemic economy.

Like all things post-pandemic, it takes time to get back to normal.

Inflation Impact

Markets have largely ignored this Budget.

Looking at the entrails, the part which interests us most is the impact of measures on inflation.

The government argues its cost-of-living relief measures — mainly around rent and energy — will reduce inflation by 0.75% in 2023-24.

If these are delivered as subsidies, not rebates, it will feed through to the Consumer Price Index. This is partly offset by a re-introduction of tobacco excise — increases of 5% a year for the next four years.

Find out about

Pendal’s Income and Fixed Interest funds

Tobacco makes up 2.75% of the CPI, so that adds 0.15% back, giving a net decrease of 0.6%.

Boosts to welfare and wages in sectors such as aged care are also inflationary, though the Budget avoids assessing those.

It will be interesting if the RBA lowers its inflation forecasts further next time, having recently lowered the 2023 forecast from 4.75% to 4.5%.

We were already at 4% for our forecast. We will further analyse the detail to see if that needs revising after this Budget.

Stage 3 tax cuts centre stage

We expect discussions to turn quickly to the Stage 3 tax cuts due in July 2024.

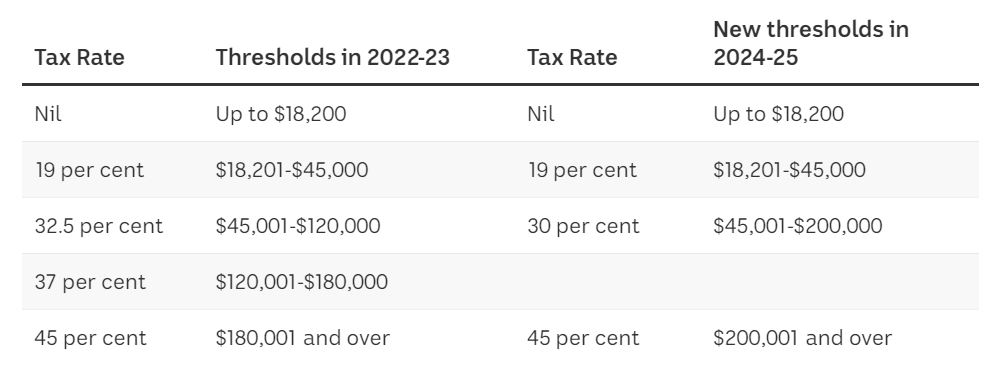

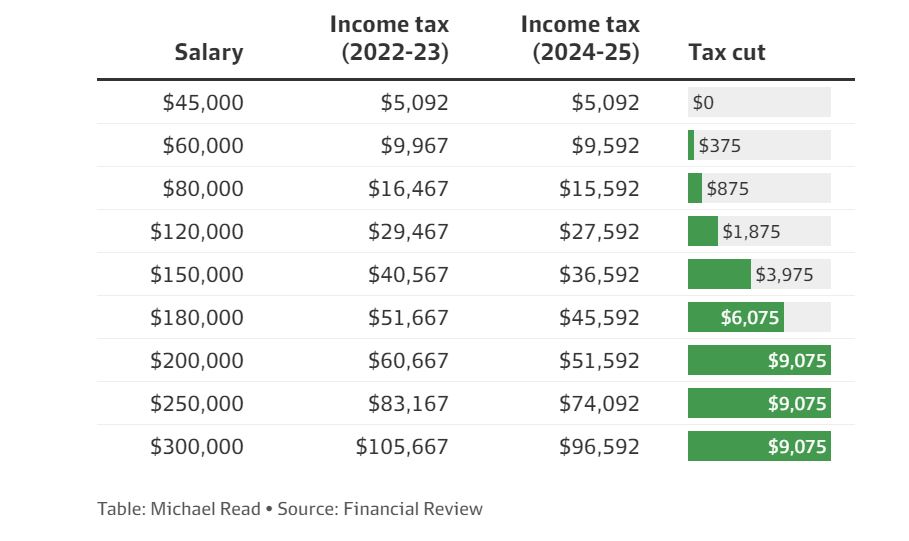

This is due to their sheer scale and the impact they will have on consumer’s pockets. Below you can see tables from ABC News and The Australian Financial Review showing the impact of these cuts, which are already in law:

If you earn $100,000 a year, close to average full-time earnings, you get an extra $1375.

Most likely this barely compensates you for a number of years of bracket creep.

But if you earn $200,000 you get $9075 extra after the stage 3 changes.

These changes will cost the government $243 billion in lost revenue over the next decade.

Though I am less concerned about their affordability (after all, the government via the RBA owns the printing press) than the economic impact.

I am not arguing against the tax cuts, but I expect Labor may look for modifications to make them more progressive.

Lower income earners have a higher propensity to spend than save. But the economic backdrop against which they will take place is important.

We expect inflation to be nearer 3% and GDP nearer 1% by mid next year.

This will make the tax cuts economically affordable, since their boost to inflation and activity will be manageable.

But it does mean the RBA may be more reluctant and slower to cut rates.

Either way the budget discussions will quickly turn to this important change leading into next year’s budget.

As mentioned, the cuts are already law so if the government wants to modify them it will need to get the legislation through well before the next Budget.

About Tim Hext and Pendal’s Income & Fixed Interest boutique

Tim Hext is a Pendal portfolio manager and head of government bond strategies in our Income and Fixed Interest team.

Tim has extensive experience in banking, financial markets and funding including senior positions with NSW Treasury Corporation (TCorp), Westpac Treasury, Commonwealth Bank of Australia, Deutsche Bank, Bain & Co and Swiss Bank Corporation.

Pendal’s Income and Fixed Interest boutique is one of the most experienced and well-regarded fixed income teams in Australia.

The team won Lonsec’s Active Fixed Income Fund of the Year award in 2021 and Zenith’s Australian Fixed Interest award in 2020.

Find out more about Pendal’s fixed interest strategies here

About Pendal

Pendal is a global investment management business focused on delivering superior investment returns for our clients through active management.

In 2023, Pendal became part of Perpetual Limited (ASX:PPT), bringing together two of Australia’s most respected active asset management brands to create a global leader in multi-boutique asset management with autonomous, world-class investment capabilities and a growing leadership position in ESG.

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current at May 10, 2023. PFSL is the responsible entity and issuer of units in the Pendal Monthly Income Plus Fund (ARSN: 137 707 996) and Pendal Dynamic Income Fund (ARSN: 622 750 734) (Funds). A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com