Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Tim Hext: Ready for a spring like no other as darker days fade

We’re getting ready to live with Covid — and we’re getting ready to spend again, writes Tim Hext in his weekly bond, income and defensive strategies outlook

THIS WEEK New South Wales embarked on a journey to re-opening. The state government announced plans to ease lockdowns as key vaccination hurdles are met.

Australia has started down a path of living with Covid.

Many countries are already in the living-with-Covid phase.

The transition will be bumpy. But three pillars will ensure a sustained recovery: increasing levels of vaccination, strong fiscal support and continued monetary stimulus.

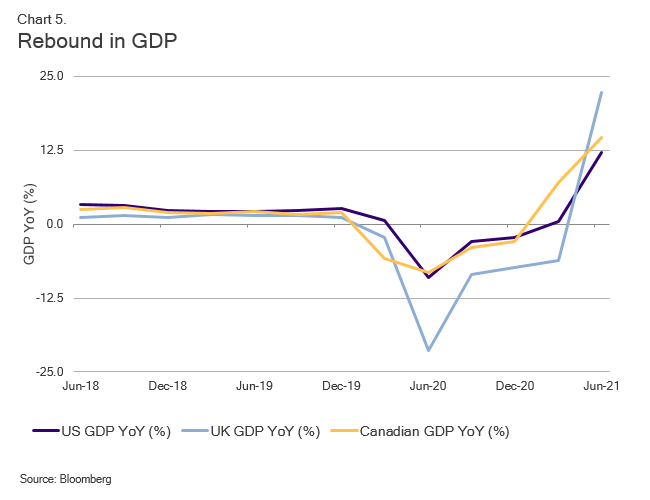

Sharp rebounds in economic activity in the US, UK and Canada paint a picture of what Australia could be like in the near future.

Better health outcomes from higher vaccination rates are allowing greater freedom of movement in those countries.

That gives us hope of returning soon to a level of normality.

Recovery: replaying an old tune

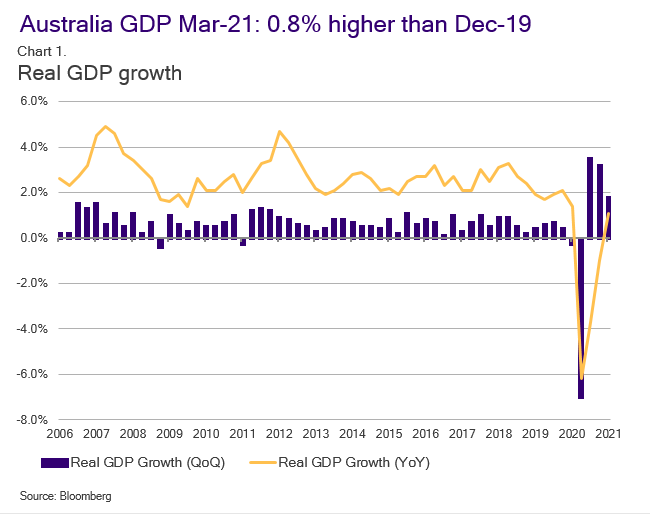

Australia had a strong start to 2021 as the recovery from March 2020 gathered steam.

The economy appears to have done a U-turn after the spread of the Delta strain in June.

Find out about

Pendal’s Income and Fixed Interest funds

Still, the change in circumstances won’t impact the economy as much as it did in March 2020, because measures to support the economy remain in place.

This is a hibernation for many businesses. With savings once again building, lost activity will rebound quickly.

Most of the direct costs of the current lockdowns across the nation are cushioned by state and federal government assistance. That will assist the recovery once lockdown ends, as was observed in the first half of 2021.

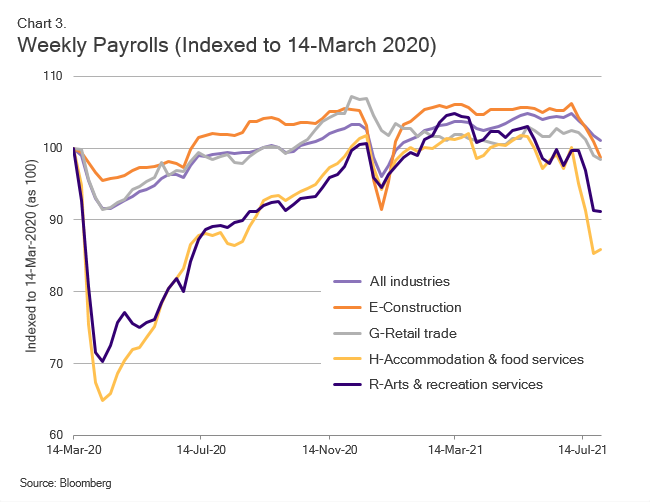

Pent-up demand for retail services, travel and recreation, as well as construction activity will rebound sharply once this hibernation ends.

Expect to see similar strong economic data as we did in Q1 2021, a year after the March 2020 Covid impact:

It’s also important to note that current lockdown measures have not had the same level of negative impact on payrolls as they did in March 2020:

Australian consumers are ready to spend for summer. They’re just waiting for the opportunity.

A word of caution

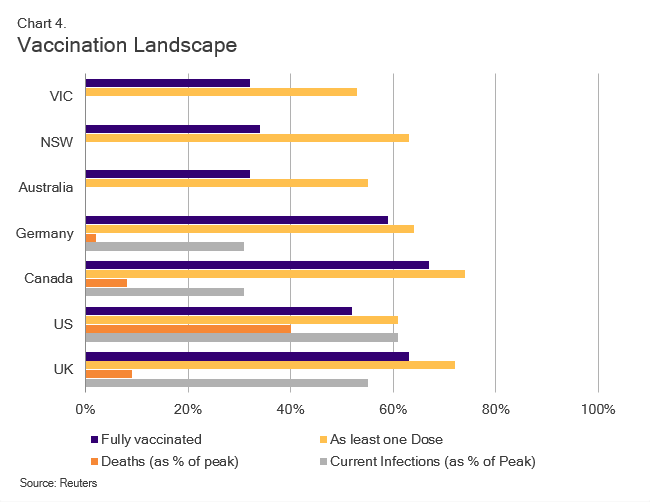

Even as countries such as the US and UK rebound from lockdowns, it is not a complete rosy picture. Infections can still occur, especially among the unvaccinated.

Stark improvements in hospitalisation and death rates for the vaccinated have prompted many industries to mandate jabs for staff:

- The US Pentagon is making vaccination mandatory for all defence troops

- New York’s school board requires all public school employees to be vaccinated

- Delta Airlines has implemented policies with very severe penalties for unvaccinated staff

Concerted efforts to increase vaccination rates and keep the economy open have resulted in strong GDP rebounds in those countries.

This shows high vaccination rates will pave the way forward:

What this means for investors

Our view is the Reserve Bank of Australia will delay any further tapering talk, at least for the rest of 2021.

The RBA has already stopped the Term Funding Facility, capped Yield Curve Control at April 2024 and reduced Quantitative Easing from $5 billion to $4 billion per week from September.

Given current uncertainties they will think they have done enough for now. But they are in glass half-full mode, so they will talk up the rebound.

We think in medium term they will be right — so expect yields higher into 2022.

We continue to expect higher inflation in 2022, so we prefer inflation bonds to nominal bonds for now.

About Tim Hext and Pendal’s Bond, Income and Defensive Strategies (BIDS) boutique

Tim Hext is a portfolio manager with Pendal’s Bond, Income and Defensive Strategies (BIDS) team.

Pendal’s BIDS boutique is one of the most experienced and well-regarded fixed income teams in Australia. In 2020 the team won the Australian Fixed Interest category in the Zenith awards.

With the goal of building the most defensive line of funds in Australia, the team oversees A$22 billion invested across income, composite, pure alpha, global and Australian government strategies.

Find out more about Pendal’s fixed interest strategies here

About Pendal Group

Pendal is an independent, global investment management business focused on delivering superior investment returns for our clients through active management.

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at August 27, 2021. It is not to be published, or otherwise made available to any person other than the party to whom it is provided.

This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.

The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund.