Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

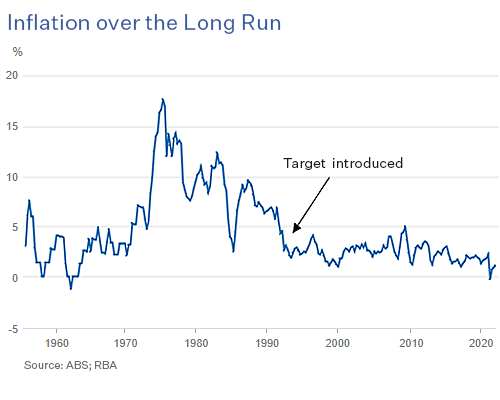

Inflation and wages could return to the target range quicker than the RBA thinks

The biggest question in local and global financial markets is no longer about the COVID pandemic. It’s about inflation and whether it will stick around.

- The current bout of inflation is more than transitory.

- RBA models have a bias toward low price rises.

- Mortgage rates likely to start drifting higher

CENTRAL BANKS around the world acknowledge that the global economy is in the midst of a bout of inflation. Most argue it’s transitory, driven by supply-side effects that will dissipate later in 2021.

But has the Reserve Bank of Australia, and its peers, got it wrong?

Quite possibly, says Tim Hext, portfolio manager in Pendal’s Bond, Income and Defensive Strategies team.

“We think that inflation and wages will come back to the RBA target range a lot quicker than the Reserve Bank thinks.”

One of the reasons for the central bank’s potential misreading of the economy is because it forecasts inflation using a model developed about five years ago, which picks up on inflation expectations, Hext says. And expectations over recent years have been low.

“So the model says … the best guide to future inflation is past inflation, because of people’s expectations. It says businesses will be slow to increase prices and consumers won’t be expecting inflation to be a problem. It has a bias in it.”

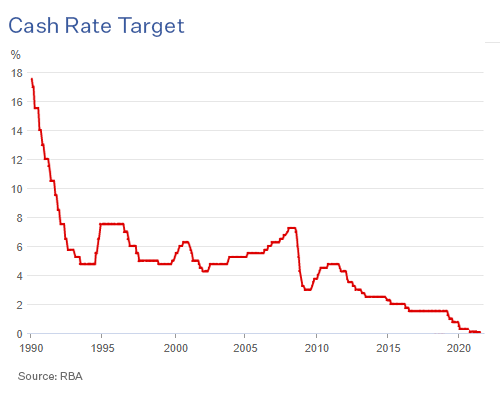

Another reason for the likelihood of the official cash rate rising sooner than the RBA’s current forecast of 2024 is because it came out so publicly about rates remaining low in an effort to stem the downturn in the economy.

“The Reserve Bank is like a big oil tanker. It takes time to turn around,” Hext says. “After providing strong guidance last year, everything in the economy started improving.

“It’s gotten to the point where they’re now using inflation to fit their narrative, as opposed to building their narrative around inflation.”

“It suits them to use the inflation figures [which are very low], but you have to remember that inflation lags the economy by 12 to 18 months. The economy started to pick up in the middle of last year, so I expect to see inflation at the end of this year,” Hext says.

He doesn’t support the view that the supply-induced price rises, currently apparent in the economy, are transitory.

“You’re going to see goods prices squeezed and businesses are in a pretty good position to pass on the cost increases. The data is already showing that in the US.

“And services inflation, which is more important than goods inflation, is exposed to labour markets. Labour is the primary input into services. And the labour market is going to get a lot stronger. It’s likely to be near four per cent this time next year.”

The oil tanker, as Hext puts it, will have to start turning.

Find out about

Pendal’s Income and Fixed Interest funds

The first thing the Reserve Bank did was switch off the term funding facility for banks at the end of June, thereby denying lenders a cheap source of funds, Hext says.

They have also announced a taper of quantitative easing by reducing purchases of government bonds from $5 billion a week to $4 billion a week in September, although recent lockdowns may see that timing pushed back.

And finally the central bank will have to lift the official cash rate, which is used to price other lending rates.

Hext says the term funding facility played as big a role on interest rates for mortgages on the way down and is likely to do so on the way back up.

“The money the banks borrow [to lend to customers] will be at a higher rate once the funding facility ends. It will take time to work through the system, but the overall cost of funding for banks will go up. And mortgage rates will start drifting higher.”

The spectre of inflation is back, and as Hext puts it, the Reserve Bank oil tanker might need to turn just a bit faster.

About Tim Hext and Pendal’s Income and Fixed Interest boutique

Tim Hext is a portfolio manager with Pendal’s Income and Fixed Interest team.

Pendal’s Income and Fixed Interest boutique is one of the most experienced and well-regarded fixed income teams in Australia. In 2020 the team won the Australian Fixed Interest category in the Zenith awards.

With the goal of building the most defensive line of funds in Australia, the team oversees A$22 billion invested across income, composite, pure alpha, global and Australian government strategies.

Find out more about Pendal’s Income and Fixed Interest strategies here

About Pendal Group

Pendal is an independent, global investment management business focused on delivering superior investment returns for our clients through active management.

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at July 28, 2021. It is not to be published, or otherwise made available to any person other than the party to whom it is provided.

This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.

The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund.