Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Fixed income: Are bonds ready to do their job again?

What’s the role of fixed income in portfolios right now? Here’s a quick snapshot from Pendal’s head of income strategies AMY XIE PATRICK

IT’S been a tough year for fixed income.

Fuelled by bouts of inflation tantrum, a rise in yields drove one-year total returns on most major fixed income benchmarks into the red by early November.

Only high-yield benchmarks delivered positive returns — mostly due to the recovery of credit spreads that took place at the start of the year.

Though this doesn’t help the average fixed income allocation much, since the risk-and-return profile of global junk debt is more akin to equities than fixed income.

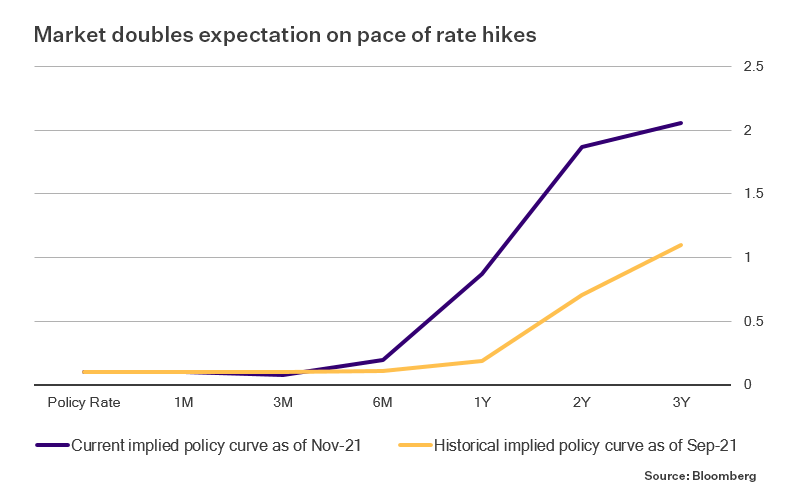

The market currently out-hawks all central banks, pricing in a steeper path of normalisation than policy makers are willing to concede.

As you can see in the below chart, since the end of September the market has doubled its expectation around the pace of rate hikes in Australia.

That leaves a decent buffer for central banks to get “pulled-to-market” if they are wrong — and a lot of room for yields to fall if they are right.

Such a steep path of rate hike expectations leave little room for error. The latest Omicron Covid variant is a case in point.

Let’s also not forget the efficiency of markets that run ahead of hiking cycles.

From 2004 to 2006, Alan Greenspan’s Fed raised policy rates by 425bps. Over the same period, yields on US 10-year Treasuries rose a mere 33bps.

Any hiking cycle now would be hard pushed to even match half of Greenspan’s pace.

Even with inflation still rising, fixed income has an important role to play.

Its negative correlation to equity markets delivered a poor return outcome for the asset class in 2021.

But overall, portfolios have benefited from the tear that risk assets have been on.

In times of market stress that negative correlation will prove invaluable.

Compared to a year ago, 10-year government bonds in Australia now provide 85bps more yield.

There is now a fatter cushion to absorb any macro stumbling blocks lurking on the horizon.

About Amy Xie Patrick and Pendal’s Income and Fixed Interest team

Amy is Pendal’s Head of Income Strategies. She has extensive experience and expertise in emerging markets, global high yield and investment grade credit and holds an honours degree in economics from Cambridge University.

Pendal’s Income and Fixed Interest boutique is one of the most experienced and well-regarded fixed income teams in Australia. Pendal won the 2023 Sustainable and Responsible Investments (Income) category in the Zenith awards. In 2021 the team won Lonsec’s Active Fixed Income Fund of the Year Award.

The team oversees some $20 billion invested across income, composite, pure alpha, global and Australian government strategies.

Find out more about Pendal’s fixed interest strategies here

About Pendal Group

Pendal is a global investment management business focused on delivering superior investment returns for our clients through active management.

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 1, 2021.

PFSL is the responsible entity and issuer of units in the Pendal Monthly Income Plus Fund (ARSN: 137 707 996) and Pendal Dynamic Income Fund (ARSN: 622 750 734) (Funds). A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund.

An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested.

This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.

For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com