Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Crispin Murray: What’s driving the ASX this week

Here are the main factors driving the ASX this week according to our head of equities Crispin Murray. Reported by portfolio specialist Chris Adams.

MARKETS bounced last week on the back of falling European power prices, a lower oil price, a stalling US dollar and signs that the US economy continues to hold up.

This offset a 75bps rate hike and hawkish message from the European Central Bank and a continued rise in bond yields.

The S&P 500 rose 3.7%, off a key technical support level around 3900. This suggests it may be in a 3900-4200 trading range.

The Australian market was more subdued, up 1.5% (S&P/ASX 300) since it had not undergone as sharp a fall in recent weeks.

Australian 10-year government bond yields fell 9bps — disconnected from a 12bp rise in US 10-year Treasuries — on the back of a dovish interpretation of the RBA governor’s speech.

This week’s key data point will be US inflation (out Tuesday night Australian time), which will help shape the outlook for rates.

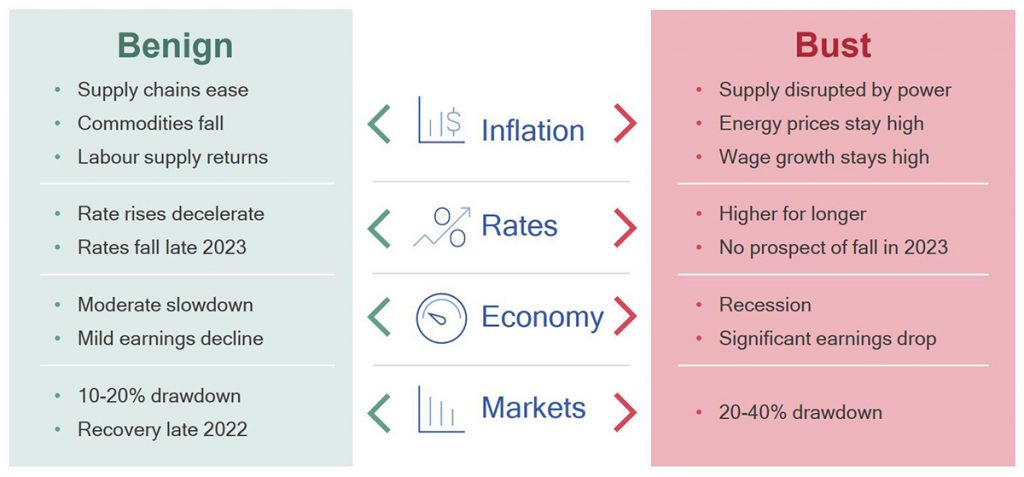

The market remains at a “sliding doors” moment between two potentially very different outcomes, shown here:

The market is like a pendulum swinging between the two outcomes.

It is reacting badly to signals of more tightening, fearing a policy mistake will trigger a recession.

It then swings more positively when data indicates the economy is more resilient and inflation signals are improving.

Policy outlook

There has been a clear shift in the market’s view on monetary policy in recent weeks.

It is now expecting more hawkish outcomes from central banks, pricing in a 75bp hike at the Fed’s next meeting, with rates peaking around 4%.

This view was bolstered by the ECB raising rates 75bps, with unanimous support from committee members.

It is also signalling further hikes over the next three-to-four meetings, with President Lagarde saying they are still far from “neutral” settings.

The market is now pricing a 60% chance of another 75bp in November, a further 50bp in December and 30bp in February. This would mean rates peaking at 2.25% early next year.

This is a substantial shift in expectations. Only two months ago the market was pricing a peak rate below 1%.

The ECB, like the Fed, has decided to front-load rate hikes.

We suspect the motivation is a combination of:

- Faster moves are containing inflation expectations and wage growth sooner, which ultimately means lower rates in the medium term

- The economy is still in reasonable shape. If it weakens, there will be greater political pressure to avoid rate increases. So it is best to act now while they can.

Real rates (nominal rates minus inflation) have risen in response to the shift in expectations around central bank policy.

US real rates were about -1% a year ago. They rose to 0.5% in June, fell back to zero, then have risen to 1% in the past six weeks.

This has contained inflationary expectations in the US and has helped support the US dollar.

We also note that rising real rates have a negative correlation to tech sector relative performance.

So the call on how much further real rates rise is key for sector positioning.

European energy impact

Ironically, European gas and power prices fell 30% and 50% respectively in response to Moscow’s decision to stop gas flow through the Nordstream 1 pipeline.

This is probably because it is seen as Russia’s trump card against the EU and there is little else to escalate an economic war.

This has given some relief to the European economic situation. But it remains very fragile, with power prices still far too high, forcing the ECB to hike faster.

We are seeing an emerging policy response to the situation.

Pendal Focus Australian Share Fund

Now rated at the highest level by Lonsec, Morningstar and Zenith

The UK announced plans to hold power prices flat at current levels for consumers and some businesses. This effectively means the UK government is short the gas market.

The support package is set to cost GBP150 billion over two years at current gas prices. If gas prices returned to recent highs it would add about GBP100 billion to the bill.

The consequences are intriguing.

It reduces the expected inflation peak from more than 15% to sub 10%, occurring in Q4 2022 instead of early next year. This helps keep inflation expectations anchored.

However it requires a lot more borrowing and helps support consumption.

This means the Bank of England may need to raise rates higher than previously expected to achieve the targeted slowdown in core inflation. UK 10-year bond yields rose 20bps to 3.1% in response.

Europe is expected set to unveil its response in the next few days.

The short-term policy will seek to:

- Cap gas prices

- Tax fossil fuel companies

- Encourage a co-ordinated reduction in energy consumption (targeting a 15% fall in gas consumption and a 5% reduction in peak energy consumption across winter)

- Examine liquidity requirements for the utility industry to prevent unintended issues such as counterparty risk.

In addition, the EU commission is reviewing the fundamental design of power markets and will report back in 2023.

This combination of a hawkish ECB, lower European gas prices and fiscal policy response led to the Euro bouncing off its lows against the US dollar. There is a school of thought that with other central banks stepping up rate hikes — and the Fed potentially slowing after September — this may mark a top in the US dollar index (DXY).

This would support a more benign outcome for markets.

Russia does have the ability to escalate the economic war should it choose to.

There is still some gas going through Ukrainian pipes (about 10% of previous Russian supply). More significantly, it still provides some 30% of Europe’s diesel supply.

US economics

On balance, US economy data remains positive.

Gas prices and freight rates continue to fall quickly. Evercore ISI survey data suggests consumer confidence is holding up, probably reflecting the lower gas prices.

Adviser Sam is invested

in making our world

A better place.

Watch as Sam meets a

mum rebuilding her life

thanks to responsible

investing

The same set of surveys show retail pricing power is falling and rents are showing signs of slowing.

It is not all good news.

A research piece from the Brooking Institute flagged that the Beveridge Curve (the relationship between job openings) shifted materially as a result of the pandemic.

The analysis indicates this is the best measure of labour market tightness and is signalling there is still substantial labour market supply shortages.

Even if two thirds of this move reversed, it would still mean inflation remaining higher for longer and requiring significantly higher interest rates to resolve.

The fact that inflation was not just a supply shock (which is resolving) but also a demand shock (notably in durable good) adds to the challenge.

The paper concludes that the Fed would need unemployment to hit 6.5% if it wanted to meet the 2.5% inflation target by December 2024.

This would mean rates have to go much higher to go than the market is currently expecting. It would also mean a significant recession.

The other conclusion to draw is that the inflation target could be shifted “temporarily”.

For example, a target of 3% inflation would require a 4% unemployment rate in 2023-24.

This is academic research and many variables could change the outcome.

But the point is that while the market focuses on near-term signals shaped by commodity price moves and inventory swings, the longer-term driver of inflation is the labour market.

There is a risk that this leads to inflation outcomes disappointing in the future.

Oil

Oil continues to trade poorly and broke down through support levels last week.

Oil bulls maintain that fundamentals are very supportive. They say financial market factors are affecting the price in the near term and these could unwind.

There are two key elements of this argument:

- Inventory levels are declining once the strategic petroleum reserve (SPR) releases are excluded, leaving underlying markets very tight

- Contrary to perceptions of a weaker global economy, demand has not been materially softer

The long-awaited Iranian oil deal now looks less likely, which removes a potential supply shock.

Australia

The RBA raised rates another 50bp, but the market was more focused more on the governor’s post-meeting comments.

There was the obvious observation that as rates get higher, there is a rising likelihood of a slowdown in rate increases.

But reference to the 2-3% inflation rate as a medium-term target was a more important dovish signal.

If central banks are prepared to allow inflation run a bit hotter for a bit longer, they don’t need to be as aggressive on the level of rates.

This is what the market and the government wants to happen. The RBA, under pressure and not wanting to be blamed for causing a downturn, appears prepared to oblige.

There is some logic to this. Australia has had a lower consumption boom, higher savings and lower wages growth than the US.

The RBA will be hoping that other central banks actions will ease global inflationary pressures, doing a lot of their work for them.

A more benign rate cycle would be good for Australian equities relative to other markets.

The risk to this approach is that inflation doesn’t fall as quickly as hoped — and we are left needing to do more later. Interestingly this is the opposite approach of most other central banks, which are signalling they will be more aggressive sooner and front-end hikes.

About Crispin Murray and Pendal Focus Australian Share Fund

Crispin Murray is Pendal’s Head of Equities. He has more than 30 years of investment experience (including 28 years at Pendal) and leads one of the country’s biggest equities teams.

Crispin’s Pendal Focus Australian Share Fund has beaten the benchmark in 12 years of its 16-year history (after fees), across a range of market conditions.

Pendal is an independent, global investment management business focused on delivering superior investment returns for our clients through active management.

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at September 12, 2022. PFSL is the responsible entity and issuer of units in the Pendal Focus Australian Share Fund (Fund) ARSN: 113 232 812. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com