Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

The Point

Quick, actionable insights for investors

Responsible Investments

Green bonds: What are they and how do you choose the right ones?

The Albanese government is getting ready to launch Australia’s first sovereign green bonds, which will fund public net-zero projects.

As with all new green bond issuances, investors will be looking to make a good return and a positive impact.

When it comes to impact, investors should be looking for “additionality” in the projects funded by Albo’s green bonds, say Pendal’s head of credit and sustainable strategies George Bishay and ESG credit analyst Murray Ackman in our latest fast podcast.

“In other words, is it actually a step change?,” asks George. “Is it just refinancing an old project or is it a new project?”

Sovereign green bonds should be able to fund bigger, riskier, more interesting projects.

“We’re wanting to see projects that bring about some kind of revolutionary change,” says Murray.

“For example, in the US we’ve seen the Inflation Reduction Act has created a market for hydrogen by subsidising it significantly.”

New weight-loss drugs offer solution to the obesity crisis

Quick view

New weight-loss drugs offer solution to the obesity crisis

Demand for a new generation of weight-loss drugs such as Novo Nordisk’s WeGovy is soaring — particularly in the US where demand is outstripping supply.

Bloomberg estimates global sales of branded anti-obesity drugs could hit $US44 billion by 2030.

While medications are not the only solution, “they are one revolutionary step forward in countering the [obesity] epidemic” noted Scientific American recently.

Some doctors say drugs like Wegovy “could help stem a tide of weight-related conditions such as heart disease or joint pain”.

Sustainable investing leader Regnan, which is part of the Pendal (and now Perpetual) family, is a long-term investor in Novo Nordisk.

“We like companies that have a relentless pursuit of continuous innovation,” says Regnan’s Maxime Le Floch says. “We want companies that innovate, have brand awareness and can build a market from scratch.”

“The main issue Novo Nordisk has had recently is keeping up with demand.”

Three ways impact investing can help diversify equities portfolios

Quick view

Three ways impact investing can help diversify equities portfolios

Impact investing works in three ways to provide diversification to traditional equities portfolios, says Tim Crockford, who heads up Regnan’s impact investing team:

- Good exposure to smaller and mid-cap companies

- Early access to future growth stocks focused on new, emerging market segments

- Long investment time frames

Impact investing funds such as Regnan Global Equity Impact Solutions Fund focus on identifying the listed companies best placed to solve the world’s biggest problems.

Right now stocks equities in the $1 billion to $10 billion range are trading relatively cheaper than their larger counterparts – an inversion of normal patterns driven by appetite for US mega-cap tech stocks, says Tim.

“You’d normally expect to pay a premium for small companies because they tend to have higher growth rates,” says Crockford. “But something has changed across 2022 and many smaller caps are now trading at a lower PE multiple than large caps.

Global Equities: Two smaller European companies that look set to make an impact

Quick view

Global Equities: Two smaller European companies that look set to make an impact

Superannuation: Should we be concerned about government intervention?

Quick view

Superannuation: Should we be concerned about government intervention?

This week saw an escalation in the political battle over the role of Super after Labor’s decision to cap concessions for those with more than $3 million in their account.

Investors might already have heightened concerns about their Super after federal treasurer Jim Chalmers last month published an essay backing a “values-based approach” to capitalism, which prompted a flurry of positive and negative responses.

What does the Chalmers essay infer about his view on superannuation – and how the $150 billion or so annual new flows into the APRA-regulated, multi-trillion-dollar system should be managed?

Pendal’s Richard Brandweiner – who also chairs Impact Investing Australia – does not believe Chalmers plans to direct superannuation funds where to invest.

Nor does he believe there is any desire or expectation for returns to be compromised.

“He wants to create infrastructure that will support return-driven investment into areas that could lead to better environmental and social outcomes.

“The way the capital in our super system is deployed will impact the world we retire into, and there’s no way around that.”

Impact Investing: where to look for innovative companies now

Quick view

Impact Investing: where to look for innovative companies now

Regnan’s Tim Crockford spends most of his time searching for smaller companies with an innovative edge in solving the world’s biggest problems.

So where should investors be looking for innovative companies right now?

Probably not among Wall Street’s big tech stocks, which Tim still sees as relatively over-valued.

“I still think they are at levels that aren’t reflecting the post-Covid norm,” says Tim, who leads Regnan’s four-person Global Equities Impact Solutions team.

In contrast, European markets offer better value, he says.

“European equities are almost the mirror image of US equities. You had a lot of bearishness priced in last year because of the conflict in Eastern Europe.

“But the market went too far, particularly in terms of profitability.

“What we are seeing coming through in the first earnings season is that more companies are surprising positively. And this isn’t just in sales, but particularly on the margin line.”

Impact investing: time for small and mid-cap stocks to shine

We can debate whether the era of easy money is over.

But there is less doubt that the era of large-cap, beta-driven, passive investing is over, says Regnan’s head of impact investing Tim Crockford.

Investors should now be considering small-and-medium companies where valuations are more appealing than large caps, says Tim, who manages Regnan Global Equity Impact Solutions fund.

“Over the long-term, small caps have been a powerful driver of returns because they typically grow their earnings much faster than large caps,” he says.

Tim’s team looks for innovation in the small and mid-cap space – particularly those with potential to address pressing environmental and social challenges.

“While valuations have come down, for the right companies fundamentals remain intact.

“Long-term growth expectations for some companies exposed to these transformational themes are too conservative.”

The new US law driving sustainable investment opportunities

Quick view

The new US law driving sustainable investment opportunities

The macro-economy – inflation, growth, employment – drives top-line sentiment among investors, observes our head of global equities Ashley Pittard.

But earnings in sectors and companies drive the valuation of specific stocks, he says.

Take Facebook owner Meta, which gained 25 per cent last week after a better-than-expected result. Then the stock fell back sharply, albeit briefly, when strong US labour force hinted at further rate rises.

Overall, the latest quarterly US reporting season is looking better than expected at the halfway point, says Ashley.

Earnings growth is down about 3 per cent “which is marginally better than what was forecast”.

Ash believes it’s time to “take a little bit of money off the table” when it comes to energy stocks.

Sustainable fashion: would you wear socks made from wood pulp?

Quick view

Sustainable fashion: would you wear socks made from wood pulp?

If you’re like most people, your clothes are made of cotton produced with pesticides, fertilisers and hundreds of litres of water.

Or they might be synthetic, made from petroleum and destined to become ocean-borne micro-plastic.

“The fashion industry has a lot to answer for,” says Maxime Le Floch, an analyst with Regnan’s impact investing team.

“Fashion is responsible for 5 per cent of annual carbon emissions. Some 6 per cent of global pesticide production is applied on cotton crops alone.”

Austria’s Lenzing Group may have an answer. It’s making fabrics from sustainably sourced wood pulp for shirts, shorts, towels, nappies and wet wipes.

Its flagship fabrics such as lyocell (pictured) are made from cellulose, the compound that makes up the cell walls of plants. The process uses 10 times less water and produces fewer carbon emissions than polyester.

Can impact investors really help change the world? Here’s evidence from Regnan

Quick view

Can impact investors really help change the world? Here’s evidence from Regnan

Can investors really help solve the world’s biggest problems?

Regnan’s equity impact investing team says “yes” — and they lay out the evidence in their first annual impact report.

Regnan Global Equity Impact Solutions fund aims to generate market-beating, long-term returns by identifying companies that are innovating and disrupting their way to solutions for the planet’s biggest problems.

The team’s inaugural impact report shows investors in the fund are helping:

-

Train young doctors in Brazil, one of the most medically under-served countries in the world (Afya)

-

Produce low-carbon cement to transform the building industry (Hoffmann Green Cement)

-

Fight homelessness (Home REIT)

-

Develop better batteries for electric vehicles that charge six times faster (Ilika)

-

Make fabric from tree fibres to replace cotton, using less water and emitting no net carbon (Lenzing)

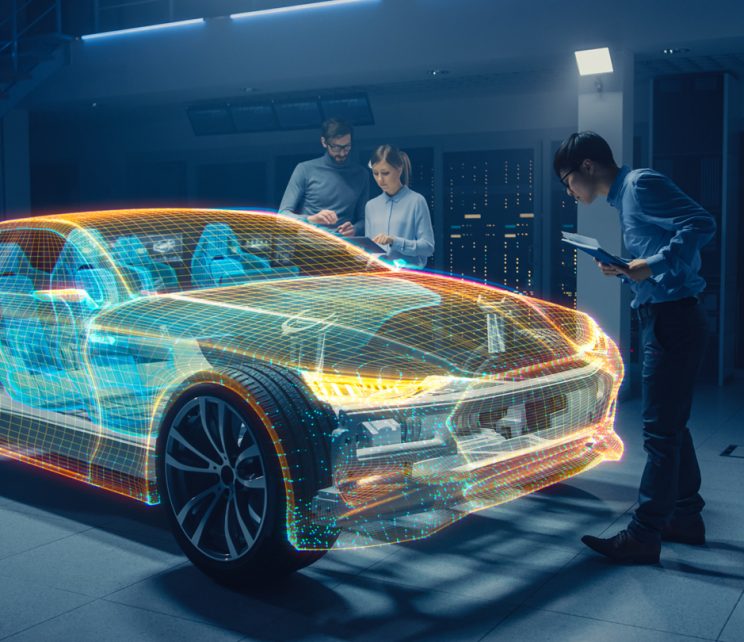

Impact investing: Computer simulations are helping solve big problems

Quick view

Impact investing: Computer simulations are helping solve big problems

You’ve driven a car designed on a computer — but have you driven one designed by a computer?

The rising sophistication of simulation software means your next car — or at least parts of it — will have its performance simulated and tested by computer software, says Regnan’s Maxime Le Floch.

The technology is dramatically cutting the time to create and test new designs, improving manufacturing efficiency and cutting costs and resources.

“We need to speed up innovation across the global economy. This is called out by UN Sustainable Development Goals 9 and 12 which highlight resource efficiency and enhancing scientific research,” says Maxime, an analyst with Regnan’s Equity Impact Solutions team.

The software is also used in the renewable energy industry to design wind turbines.

Regnan’s Global Equity Impact Solutions fund has a position in US-listed simulation software leader Ansys, which aims to “help innovative companies deliver radically better products”.

FAST PODCAST: How to choose the right mid-cap Aussie stocks

Play podcastFAST PODCAST: How to choose the right mid-cap Aussie stocks

The development of a decarbonised economy will take a long time.

But that doesn’t mean it’s not a critical factor right now, says Pendal portfolio manager Brenton Saunders.

The ESG transition can be divided into three periods, says Brenton:

- The existing status quo

- A transition period with an overlap between old and new technologies

- A transition to the new

“Once you understand that, it’s really about characterising companies in terms of where they sit in these transitions,” says Brenton, who manages Pendal MidCap Fund.

“Are they making their way across those phases to an environment where they can contend with the decarbonised, ESG world? Or are their business models fairly constrained to one of those thematics?

“We are very careful about how and if we invest in those latter sectors because this transition will take place over the course of the next 10 years. That’s definitely within the context of an investible timeframe.”

Loading posts...

Loading posts...