Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

The Point

Quick, actionable insights for investors

Global Equities

Sustainable fashion: would you wear socks made from wood pulp?

If you’re like most people, your clothes are made of cotton produced with pesticides, fertilisers and hundreds of litres of water.

Or they might be synthetic, made from petroleum and destined to become ocean-borne micro-plastic.

“The fashion industry has a lot to answer for,” says Maxime Le Floch, an analyst with Regnan’s impact investing team.

“Fashion is responsible for 5 per cent of annual carbon emissions. Some 6 per cent of global pesticide production is applied on cotton crops alone.”

Austria’s Lenzing Group may have an answer. It’s making fabrics from sustainably sourced wood pulp for shirts, shorts, towels, nappies and wet wipes.

Its flagship fabrics such as lyocell (pictured) are made from cellulose, the compound that makes up the cell walls of plants. The process uses 10 times less water and produces fewer carbon emissions than polyester.

AMY XIE PATRICK: China’s going lower on rates. Here’s what it means for investors

Play podcastAMY XIE PATRICK: China’s going lower on rates. Here’s what it means for investors

As the West hikes rates, China keeps cutting, hoping to counter the impact of its Covid-zero policy and spark demand in a debt-laden property sector (see graph below).

Will Beijing continue the course? And what does that mean for investors?

China’s monetary authorities are not independent as we know them in Australia and the US, explains Pendal’s Amy Xie Patrick in our latest fast podcast.

“The central bank in China has been lowering interest rates because the economy quite frankly is in a rut.

“Most major investment bank analysts expect growth in China will fall to levels not seen over the last decade. Frankly China will struggle to get above the 4% threshold for the next year or perhaps even more.”

If these headwinds continue to build for China, and stimulus efforts continue to be piecemeal, the outlook for global fixed income could be very bullish, says Amy.

Can impact investors really help change the world? Here’s evidence from Regnan

Quick view

Can impact investors really help change the world? Here’s evidence from Regnan

Can investors really help solve the world’s biggest problems?

Regnan’s equity impact investing team says “yes” — and they lay out the evidence in their first annual impact report.

Regnan Global Equity Impact Solutions fund aims to generate market-beating, long-term returns by identifying companies that are innovating and disrupting their way to solutions for the planet’s biggest problems.

The team’s inaugural impact report shows investors in the fund are helping:

-

Train young doctors in Brazil, one of the most medically under-served countries in the world (Afya)

-

Produce low-carbon cement to transform the building industry (Hoffmann Green Cement)

-

Fight homelessness (Home REIT)

-

Develop better batteries for electric vehicles that charge six times faster (Ilika)

-

Make fabric from tree fibres to replace cotton, using less water and emitting no net carbon (Lenzing)

Impact investing: Computer simulations are helping solve big problems

Quick view

Impact investing: Computer simulations are helping solve big problems

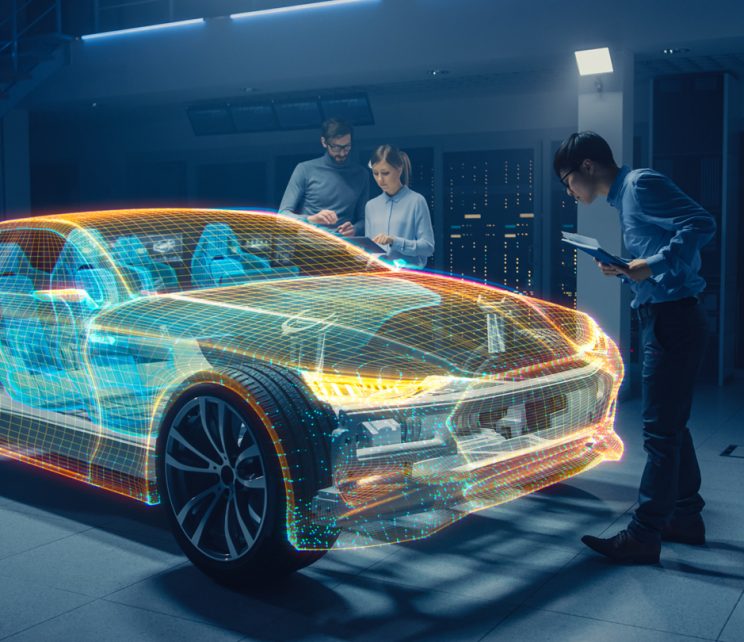

You’ve driven a car designed on a computer — but have you driven one designed by a computer?

The rising sophistication of simulation software means your next car — or at least parts of it — will have its performance simulated and tested by computer software, says Regnan’s Maxime Le Floch.

The technology is dramatically cutting the time to create and test new designs, improving manufacturing efficiency and cutting costs and resources.

“We need to speed up innovation across the global economy. This is called out by UN Sustainable Development Goals 9 and 12 which highlight resource efficiency and enhancing scientific research,” says Maxime, an analyst with Regnan’s Equity Impact Solutions team.

The software is also used in the renewable energy industry to design wind turbines.

Regnan’s Global Equity Impact Solutions fund has a position in US-listed simulation software leader Ansys, which aims to “help innovative companies deliver radically better products”.

Impact investing: How inflation is creating sustainability opportunities

Quick view

Impact investing: How inflation is creating sustainability opportunities

Higher commodity prices are triggering investor interest in companies that can recycle, process waste and optimise production to reduce costs.

That’s creating new opportunities for sustainable investors, says Tim Crockford, who leads Regnan’s Global Equity Impact Solutions fund.

Sustainable production and consumption is UN Sustainable Development Goal 12 which aims to reverse the 70 per cent growth in raw materials used in production between 2000 and 2017.

Higher inflation underpinned by soaring prices for energy, metals and food have put this UN goal at the centre of the global macroeconomic debate.

“There is obviously an environmental imperative there, but increasingly with the cost of inputs rising dramatically there is now a financial imperative,” says Tim. “It’s been a big area of focus for us in the last 18 months.”

Global equities: Time to consider good quality, long-duration assets

Quick view

Global equities: Time to consider good quality, long-duration assets

Nudgem Richyal isn’t calling the bottom of the market. Some sectors haven’t sold down, and remain at risk.

But it might be time to put some duration back into portfolios – stocks with long-term growth prospects, says the co-manager of Pendal Global Select Fund.

“The valuations of some duration assets have become much more attractive. “Health care is one area we like. It is a long-term play, and usually when inflation peaks, the baton is passed from energy stocks to healthcare stocks.

“Healthcare is a quality, long-duration asset, as opposed to speculative tech.”

Nudgem compares the recent volatility to an overflowing water tower.

“The Fed has put a lot of liquidity into the system since 2008, and that’s the equivalent of filling up the water tower,” Richyal explains.

“But then there was too much liquidity in the system, or water in the tower, and the frothy stuff at the top flowed over.

“Recently we’ve seen a mopping up of the overflow. As the excess liquidity or flow of water stops, levels start to even up and that’s what’s happening now,” he says.

Global equities: The sectors to think about now

Chris Lees: Why Ukraine tragedy is a geopolitical and financial inflection point

Play podcastChris Lees: Why Ukraine tragedy is a geopolitical and financial inflection point

It’s now clear the humanitarian tragedy in Ukraine is a major inflection point for geopolitics as well as financial markets, says Pendal Global Select Fund co-manager Chris Lees.

There are three points to understand, says Chris in Pendal’s latest fast podcast.

“Number one, obviously it’s a tragic humanitarian disaster, but it’s interesting watching how the West is rallying around to help where it can.

“Two, it is a genuine geopolitical inflection point. We must recognise that it will affect our children and our grandchildren. Germany has basically ripped up its pacifist constitution. Swiss banks have for the first time enforced US sanctions.

“Third, this is a genuine financial market regime shift. Like when water turns to ice, you’ve got to stop swimming. Then when ice turns back to water, you have to stop ice-skating.

“We’re seeing things like the rotation from growth to value seeming to stop since the Ukraine invasion. Now there’s a rotation from value to defensive, low beta, quality growth stocks for example.

“Those are the type of medium-to-long-term things we think people should be looking for.”

Global equities: Which sectors look best right now

Quick view

Global equities: Which sectors look best right now

“You want to sharpen your pencil because there might be some early birthday presents through this year,” says Pendal’s Nudgem Richyal when asked about the current market volatility – and in particular long-duration stocks in sectors like tech.

“Some of these stocks actually have pretty good business models and maybe the valuation just got a little bit overextended,” says Nudgem, who co-manages Pendal Global Select Fund. “This will be a healthy correction for those type of names.

“We think it’s too early to bet on a complete regime shift. At the moment the commentary seems to be hawkish… But we haven’t even had a rate hike yet.

“The other thing to bear in mind is value rallies tend to be short lived. So if you look at the other side – which are the short-duration stocks and how do they fare in this type of market environment? – generally they tend to do well, but it doesn’t last that long. So that becomes a market timing issue.

“The last thing is – if growth starts to slow, is there really going to be much longevity to the rate hike cycle?”

FAST PODCAST: What makes this cycle different – and which data investors should be watching

Play podcastFAST PODCAST: What makes this cycle different – and which data investors should be watching

Every cycle is slightly different, says Pendal global equities PM Chris Lees in our latest Pendal Fast Podcast.

What’s different this time?

“The Fed is starting to raise interest rates as the global economy’s already slowing,” says Chris. “In the past, the Fed was raising interest rates as the global economy was still accelerating – but because of Covid it got delayed.

“This time is slightly different in that the Fed hasn’t even started raising rates – it’s talking about it.

“Actually, if you look at GDP growth rates, they’re beginning to slow and inflation rates are probably peaking. So it’ll be a very volatile time for financial assets. It always is when interest rates go up.

“It’ll be slightly different from previous playbooks because the timing and the sequencing is different.”

Where will we land? “The bullish potential is that actually this is a normal mid-cycle correction. [But] it’s too early to tell at the moment.

“There is potential for a bear market, says Chris. “It’s a low probability potential at the moment, but every day the probabilities of that are drifting up.”

FAST PODCAST: Where to hunt for global equities opportunities in 2022

Play podcastFAST PODCAST: Where to hunt for global equities opportunities in 2022

Where are the opportunities likely to be found in global equities this year?

Look to the healthcare sector says Pendal Global Select Fund co-manager Chris Lees in this fast podcast.

“I think at the margin, you should be selling some cyclicals because we’ve had the first Covid rebound.

“Now we’re looking at a slowdown. Cyclicals tend to perform not so well and the mid-cycle stocks tend to perform much better as clearly we’re in the mid cycle now.

“That tends to be areas like healthcare.

It’s green, but is it a good investment? Here’s how to know

Quick view

It’s green, but is it a good investment? Here’s how to know

There are three things to consider when judging whether a green investment is also a good investment.

“Start by make sure what you’re considering is actually green”, says Maxime Le Floch, an analyst with Regnan’s Global Equity Impact Solutions team.

“These are very complex multi-dimensional issues and it’s not just about climate change. It’s also about ocean health, foods, wastewater and many other issues,” he says.

Second, focus on solutions with a strong relative advantage over competitors.

“It’s important to not just look at the environmental benefits of a technology but also how it performs relative to other technologies,” Maxime says.

Finally, focus on long-term opportunities.

“Investors should focus on areas where there are structural growth opportunities – offshore wind, wood-based fibres, water treatment solutions,” he says.

Loading posts...

Loading posts...