Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

The Point

Quick, actionable insights for investors

Global Equities

Global equities: What investors are missing about south-east Asian banks

Global equities investors might be wary of US and European bank stocks right now.

But this year’s slow-burn banking crisis in the West – which has seen the collapse of three US banks and the demise of Credit Suisse – has so far left Asian banks relatively unscathed, points out Pendal’s Samir Mehta.

Resilience among Southeast Asian banks indicates a growing maturity among regulators and governments in the region that may be missed by investors, says Mehta, who manages Pendal Asian Share Fund.

Experienced investors will recall Southeast Asia’s currencies, markets and banking systems were heavily impacted in the 1997 crisis and GFC.

But the environment for banks has improved in Singapore, Indonesia, Malaysia and even Thailand, says Samir.

Why passive investing isn’t as passive as you may think

Quick view

Why passive investing isn’t as passive as you may think

Passive investing has become popular due to low costs and high diversification.

But it often means owning poor performers that an active manager can avoid, argues Pendal’s Samir Mehta.

Many investors fail to appreciate the process of selecting securities for an index is an active investment process that carries a level of risk, says Samir, who manages Pendal Asian Share Fund.

“Investors should think about this presumption that passive investment is really passive.

“There’s a group of people deciding which stock goes into which index, in what proportion — and there is a timing element as well.

Samir points to Tesla which was added to the S&P 500 in 2020 after a ten-fold share price rise. Index fund investors who passively bought the shares then are now down on their investments.

“Active managers contribute not only by identifying good businesses, but also by taking a view on what not to own,” says Samir.

Samir Mehta: Protectionist Indonesia is looking attractive in 2023

Quick view

Samir Mehta: Protectionist Indonesia is looking attractive in 2023

Investors should take a new look at Indonesia, where export restrictions are driving new domestic industries, says Pendal’s Samir Mehta.

The protectionist policies of President Joko Widodo are driving transformation in a country once dubbed the ‘sick man of Asia’, says Samir, who manages Pendal Asian Share Fund.

A ban on nickel exports has encouraged a domestic stainless steel industry that’s now among the world’s biggest exporters.

A ban on exporting the bauxite used to make aluminium will come into force this year. Capturing the supply chain for electric vehicle batteries is also on the Indonesian agenda.

Indonesia’s trade balance could be in a sustained surplus while foreign direct investment rises, says Samir.

Lower interest rates, reduced currency volatility and higher growth could compound benefits for investors.

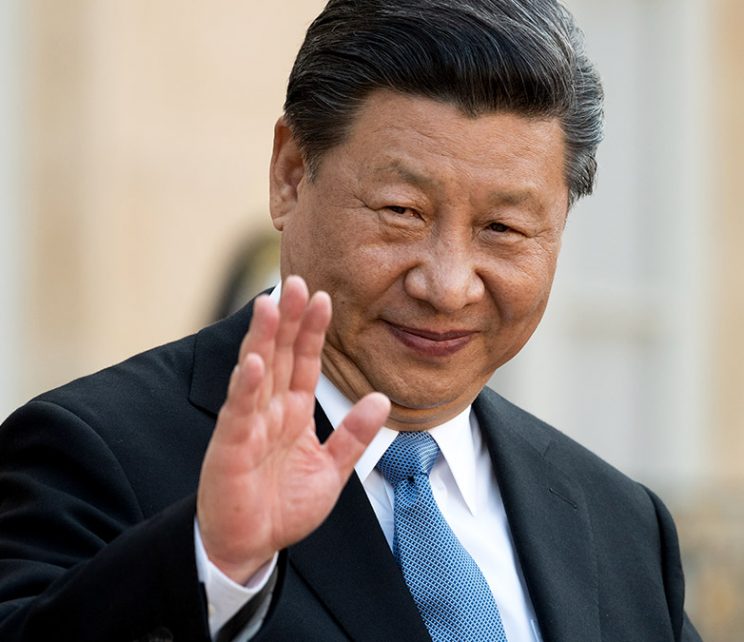

It’s time to change how you think about investing in China

Quick view

It’s time to change how you think about investing in China

The cementing of Xi Jinping’s power in China “completely changed” the environment for investors, says our Asian Share Fund manager Samir Mehta.

“President Xi today exercises complete control over society in a modern state with technology and surveillance unparalleled in history.”

This has important implications for government policy, the economic outlook — and therefore investors, says Samir.

“Economic outcomes like employment and growth will become secondary to satisfy Xi’s idealism of zero Covid.”

The hard-line ideological approach introduces investment risks that most investors have no experience with, he says.

“In the long run, when it comes to investing in China, I’m going to be a lot more cautious.”

What does Xi Jinping’s consolidation of power mean for investors?

Quick view

What does Xi Jinping’s consolidation of power mean for investors?

Confirmation of Xi Jinping’s third term as China’s leader wasn’t surprising, but his apparent control is greater than most expected.

It appears Xi’s main aim is to turn the “successfully achieved moderately prosperous society” into a “modern socialist society”.

“This is seen as part of China’s ambitions to be an independent technology powerhouse and to project power and influence,” says Pendal’s Brenton Saunders.

“This may suggest the economy remains on a relatively austere pathway by historical standards.

“The potential for China’s property market remains muted. Material stimulus is unlikely beyond the short term.”

That’s a headwind for economic growth and demand for steel-making materials, Brenton says. “Iron ore and coking coal stocks are most exposed to the trend long term.

“But China’s strategic pivot to technology, grid investment and electric vehicles should benefit base metal and lithium-producing companies in the long term.”

Markets are underestimating structural change in commodities

Quick view

Markets are underestimating structural change in commodities

Russia’s invasion of Ukraine has caused structural change to commodity markets which will be with us for a generation, says Pendal’s Brenton Saunders.

The market is underestimating the depth and longevity of those changes says Brenton, who manages Pendal Midcap Fund.

The war will lead to long-term rises in commodity prices, and buyers are likely to turn to Australia for commodities they once bought from Russia.

“When you speak to the BHP marketing and logistics team who are managing these cargoes for customers all over the world, you can see the impact and implications are wide-ranging and immediate.

“You’ve got ships that won’t go to certain parts of the world anymore to transport commodities. Ships that can’t get insurance to go to certain parts of the world. Traders that can’t get collateral to deal with parts of the world they have been dealing with for decades.

“This is the biggest dislocation I’ve ever seen in commodity markets.

“The war will end — and we pray it does quickly — but the implications will be with us for a generation.”

Global equities: Power shift brings new investment opportunities

Global equities: where to hunt for smalls and midcaps

Quick view

Global equities: where to hunt for smalls and midcaps

“Now is the time for small and mid-caps to shine”, says Regnan portfolio manager Tim Crockford.

“Particularly in Europe, relative valuations have reached depressed levels that are not reflective of the underlying relative fundamentals,” says Tim, who leads Regnan’s global equities impact investing team.

“In terms of developed markets, Europe and Japan offer opportunities. In terms of emerging markets, it’s places like Indonesia and Brazil,” Tim says.

Focus on companies that are likely to grow over the next 12 months – or where the valuation is so depressed it’s priced for a highly negative drop in growth in 2024, he argues.

“Look for companies that are able to generate organic cash flows to fund at least part of their growth.

“And the remainder of the funding needs to be covered by debt that isn’t going to burden, or reverse, the positive effects of potential future cash flow growth.”

Impact investing: How GLP-1 drugs could affect sectors outside healthcare

Quick view

Impact investing: How GLP-1 drugs could affect sectors outside healthcare

GLP-1 medication – best known in drugs such as Ozempic and Wegovy – could have impact far beyond the treatment of diabetes and obesity.

That’s the view of Maxime Le Floch, an analyst with Regnan’s impact investment team, who has been reviewing recent studies.

Regnan invests in Novo Nordisk, one of the two dominant GLP-1 drug makers along with Eli Lilly.

Demand for GLP-1 is already outstripping supply – and potential health benefits uncovered in recent studies could drive demand higher.

Results from a recent study on cardiovascular risk using Novo Nordisk’s GLP-1 were “far better than expected,” says Maxime. Another trial on chronic kidney disease was stopped early because of the success of GLP-1.

And there is now evidence that the use of GLP-1 weight-loss drugs may be affecting sales of certain food categories.

Global equities: Where to look for AI winners

Quick view

Global equities: Where to look for AI winners

Looking for exposure to artificial intelligence?

Go beyond big tech and look for companies using AI to improve efficiency or competitive advantage, says Pendal global equities analyst Sue Scott.

For example, copper miner Freeport-McMoRan has lifted output by as much as 5 per cent at some of its facilities using AI. Energy group Total is using AI to help deploy solar to its worldwide service station network.

“There’s a lot of hype factored into what AI means for future earnings,” says Scott.

“But our focus has been looking at the companies where AI is being successfully used as a tool for productivity and product development.

“Some companies will be faster than others. Our investment philosophy is always to own the dominant players in any particular market.

“To keep their edge, it’s important for us to see that they’re at least looking at these kinds of technologies.”

New weight-loss drugs offer solution to the obesity crisis

Quick view

New weight-loss drugs offer solution to the obesity crisis

Demand for a new generation of weight-loss drugs such as Novo Nordisk’s WeGovy is soaring — particularly in the US where demand is outstripping supply.

Bloomberg estimates global sales of branded anti-obesity drugs could hit $US44 billion by 2030.

While medications are not the only solution, “they are one revolutionary step forward in countering the [obesity] epidemic” noted Scientific American recently.

Some doctors say drugs like Wegovy “could help stem a tide of weight-related conditions such as heart disease or joint pain”.

Sustainable investing leader Regnan, which is part of the Pendal (and now Perpetual) family, is a long-term investor in Novo Nordisk.

“We like companies that have a relentless pursuit of continuous innovation,” says Regnan’s Maxime Le Floch says. “We want companies that innovate, have brand awareness and can build a market from scratch.”

“The main issue Novo Nordisk has had recently is keeping up with demand.”

Barbie might be queen, but content is king when investing in Hollywood

Quick view

Barbie might be queen, but content is king when investing in Hollywood

Global equities investors observing the Barbenheimer phenomenon might be wondering how to get exposure to Hollywood right now.

Blockbuster films Barbie and Oppenheimer may be breaking box office records.

But all the hype can’t hide the fact that showbiz is a complex investment environment with actors and writers strikes, a super-competitive streaming market and the challenge of AI-generated content.

“For investors, it comes down to the age-old adage, ‘content is king’”, says Sue Scott, senior investment analyst for Pendal Concentrated Global Share Fund.

Sue and her team are investors in Warner Bros. Discovery – the studio behind Barbie – as well as Netflix.

The writers and actors strike – which could last into next year – underlines the importance of choosing companies with a good library of content such as Netflix and Warner, says Sue.

Loading posts...

Loading posts...