Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

The Point

Quick, actionable insights for investors

Australian Equities

What’s driving ASX stocks this week

Three things stood out among the best industrials this ASX earnings season

Quick view

Three things stood out among the best industrials this ASX earnings season

What did the best-received results have in common this ASX earnings season?

Among industrials – which includes industries such as transportation and machinery – it was all about pricing power, cost of debt and where a company sits in its business cycle, says Pendal analyst Anthony Moran.

“Some companies with pricing power have not only kept up with prices, but have also been able to achieve some margin expansion,” says Anthony. He points to James Hardie and Boral as examples.

This season marked a return to more typical themes after cost control, staffing and inflation dominated post-Covid reporting, Anthony says.

And don’t forget the weather.

“It’s not just resilient demand in Australia. It’s also the good weather. That’s quite significant for Australian construction companies.”

What about the rest of the ASX? Find out next Thursday when Pendal’s head of equities Crispin Murray delivers his bi-annual Beyond The Numbers report.

Crispin Murray: What’s driving Aussie equities this week

Quick view

Crispin Murray: What’s driving Aussie equities this week

Confidence in China continues to weaken.

High youth unemployment is deterring consumer spending. Fears about the solvency of private developers are discouraging new home purchases.

Investment trust defaults such as Zhongrong risk triggering redemption requests, leading to a potential liquidity squeeze.

A number of incremental policy initiatives have been unable to reverse deteriorating sentiment.

Despite the bearish portrait, our head of equities Crispin Murray notes that some China-related stocks and ASX sectors have held up – notably the miners.

The bulls are taking the view that things are so bad, they’re good – which increases the chance of a more convincing policy response such as the one we saw in 2015, says Crispin.

“They are drawing a comparison with the period prior to the reversal of the Zero-covid policy, where there were incremental signals before a major policy change,” says Crispin.

If a major policy response doesn’t materialise, Crispin sees some risk around bulk commodity producers at these levels.

Elise McKay: The questions to ask this ASX earnings season

Quick view

Elise McKay: The questions to ask this ASX earnings season

ASX earnings season kicks off next week. What should Aussie equities investors be looking for?

Much more than revenue and profit margins, says Pendal investment analyst Elise McKay.

The macro-economic environment will play a big part, predicts Elise.

“In the US, even though companies are delivering better earnings, their share prices aren’t going up on the news.

“The recent market outperformance has been driven by the macro environment, not the earnings.”

Elise says investors should be asking: “Have companies maintained the ability to pass through higher prices? What’s happening to wages? Are further cost reduction programs announced?”

Look out also for how companies are managing opportunities and threats related to artificial intelligence, she says.

Crispin Murray: What’s driving Aussie equities this week

Quick view

Crispin Murray: What’s driving Aussie equities this week

Crispin Murray: What’s driving Aussie equities this week

Quick view

Crispin Murray: What’s driving Aussie equities this week

EQUITIES continue to rally even as bond yields rise on the back of the Fed’s “hawkish pause” which held rates steady but added in a second rate rise by the year’s end to the “dot plot”.

The market is not convinced of the need for that hike, with CPI data indicating inflation is coming down.

There has been some good news recently.

Jim Taylor: What’s driving ASX stocks this week

Each week our Aussie equities team runs through the factors driving the Aussie stock market.

Observations on two major forces stood out in the latest report from PM Jim Taylor – one in the virtual world and one in the physical world.

On the AI mania gripping US markets, Jim noted that last week was the biggest ever weekly inflow into US listed tech companies at close to $US9 billion, according to researcher EPFR.

“That’s about 40% more than the next biggest inflow in 2021.”

Those more invested in the physical world would have noted the Bureau of Meteorology updating its El Niño-Southern Oscillation outlook from “watch” to “alert”.

“This means about a 70 per cent chance of El Niño forming in 2023 – roughly three times the normal chance,” said Jim.

“After three years of high rainfall, the ‘weather ate my homework’ excuse may be taken off the table for many ASX-listed companies.”

What’s driving ASX stocks this week

Quick view

What’s driving ASX stocks this week

Do spikes among US chipmakers such as NVIDIA and Marvell mark the start of a multi-year, AI-driven bull cycle?

What might it mean for ASX stocks?

NVIDIA and its rivals are churning out Graphics Processing Units which are in-demand for AI services such as OpenAI’s ChatGPT.

Pendal equities analyst Elise McKay notes that just seven US tech mega caps (Apple, Microsoft, Alphabet, Amazon, NVIDIA, Meta and Tesla) have driven most of the 25% NASDAQ rally this year.

“But valuation metrics for this group do not seem stretched,” she says. “They are growing, making efficiency gains, have strong balance sheets, are buying back stock and may be moving into a more favourable macro and interest rate backdrop.

“While timing and take-up of accelerated computer infrastructure is uncertain, we expect this to be a net positive for ASX-listed data centre player NEXTDC.

“There could also be a positive impact for Macquarie Technology’s data centre business and Megaport on the network-as-a-service side.”

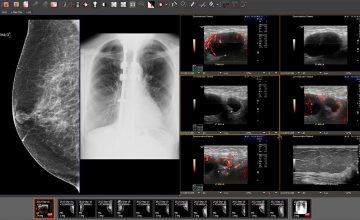

ASX midcaps: Why medical imager Pro Medicus has captured our attention

Quick view

ASX midcaps: Why medical imager Pro Medicus has captured our attention

Sam Hupert started as a GP in 1980 and within a couple of years realised the then-nascent world of computing would have a big impact on medicine.

Within three years he’d started Pro Medicus, an imaging software provider working with hospitals, imaging centres and health care groups.

Today the ASX-listed group – held in Pendal Midcaps Fund – is worth more than $6 billion.

The global diagnostic imaging market is worth some $US28 billion globally – and growing at 4.9%, according to Grand View Research.

Growth drivers include an increasing prevalence of lifestyle-related diseases, rising demand for early detection tools, speedier diagnosis, government investment and expansion into developing nations, Grand View reports.

Pro Medicus is mainly in radiology now, but its technology could be used in cardiology, ophthalmology and pathology and all areas of reflected light, says Pendal equities analyst Oliver Renton.

Crispin Murray: Pollution law shows investors need to keep a close eye on government

Quick view

Crispin Murray: Pollution law shows investors need to keep a close eye on government

Government policy is a significant risk to investors, particularly in the resources and energy sectors, says our head of equities, Crispin Murray.

Sovereign risk can be more unpredictable than competitor risk, Crispin told a recent AFR conference.

“Competitors are largely focused on returns, so you can anticipate what they’re likely to do. But governments overlaying policy agendas can create quite unpredictable risks.

As an example, Crispin points to the federal government’s “safeguard mechanism” law which will regulate Australia’s 215 biggest polluters from July.

“They are still negotiating on details, but it means we’re asking mining companies, as an example, to quickly cut their scope-one emissions.

“That means cutting diesel emissions over the next seven years – and there’s no solution to that.

“I think we will see carbon price go up more than people realise. And it’s not beyond the realms of possibility we’ll see a carbon price by the end of the decade.”

How Pendal investors helped make the world a better place in 2022

Quick view

How Pendal investors helped make the world a better place in 2022

As “stewards of capital”, Pendal undertook 562 ESG-related meetings with investee companies and issuers on behalf of investors in 2022.

These “engagements” – where we seek to influence positive outcomes on ESG matters – are one of the benefits of investing with an “active” investment manager.

Deep, fundamental research capabilities in this area are increasingly important, says Pendal’s Richard Brandweiner in our 2022 stewardship report (which you can find here).

“The challenge for investors is identifying authentic leadership that can leverage non-financial factors to generate real economic value,” Richard says.

“Since many of the basic hygiene factors are already considered, it will become particularly difficult for systematic processes like those used by the mainstream ESG score providers to assess this.”

Crispin Murray: Four government intervention areas investors must watch

Quick view

Crispin Murray: Four government intervention areas investors must watch

Investors should keep a close eye on a growing trend toward government policy intervention in business, says Pendal’s head of equities, Crispin Murray.

“As investors our focus is on the practical reality of the market environment,” Crispin says in his biannual Beyond The Numbers webinar.

“One key shift we have seen is the number of companies referencing the growing influence of government policy on their outlook.”

Investors should be aware of government influence from four perspectives, he says:

1 Determining award wages

2 Power and gas policy

3 The carbon reduction pathway

4 Potential new regulations for the big banks

Loading posts...

Loading posts...