Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Tim Hext: Take note of these two graphs in the RBA’s monetary statement

Here’s our weekly Bond, Income and Defensive Strategies note from Pendal portfolio manager Tim Hext.

THE latest RBA statement on monetary policy is a great read, not just for thoughts on the economy but for the graphs.

The RBA’s vast team of economists always find new and interesting ways to look at the state of play.

There were several that caught our eye this time.

We are truly in a world of money printing

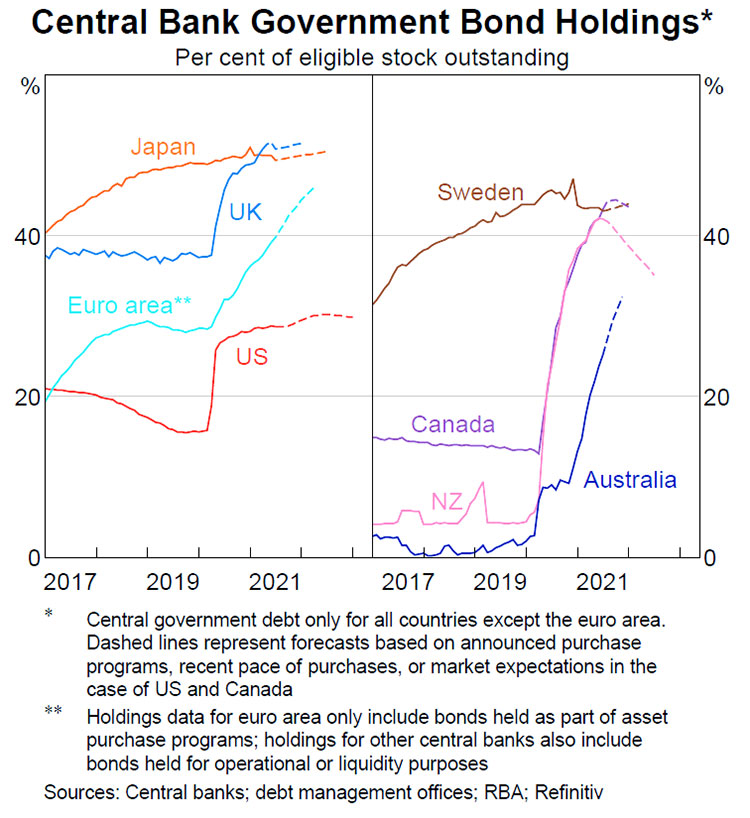

The first graph below shows how much government bond markets are owned by central banks.

This is the government printing money to finance the government. And still no inflation. Modern Monetary Theory is onto something here.

The message from the RBA seems to be: relax, we’re not even in the medals.

These purchases and super-low cash rates are all part of a slow and subtle financial repression.

Rather than having people go backwards nominally, just keep rates below inflation and have savers go backwards in purchasing power.

At first this is not noticed too much. Since growth assets re-rate higher with negative real yields, asset owners sit back happily. This is the period we are still in.

But eventually this will eat away at our standard of living — especially as inflation picks up.

Most of the world’s GDP is opening up and living with 50-60% vaccination rates

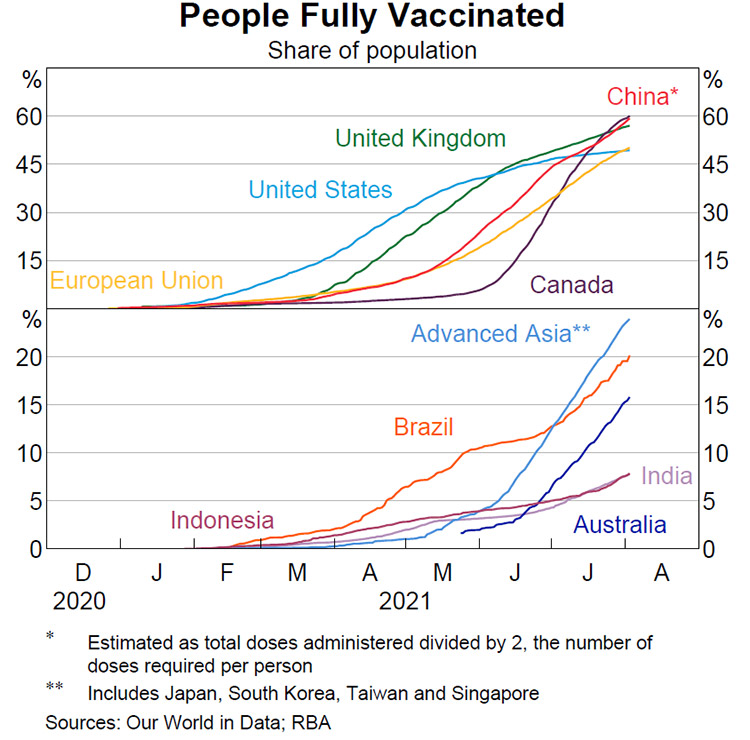

This second graph will come as no surprise to locked-down readers.

Australia’s developing country status in vaccines versus our developed peers is shown here. I guess our success and eventual complacency in 2020 came back to bite us in 2021.

This graph shows that the majority of the world’s GDP is now opening up and living with the virus at around 50-60% vaccination rates.

By 2022 we should be opening and hopefully seeing the end of lockdowns.

Pent-up savings and demand should see a strong rebound in the economy and some wage and price pressures.

Other than that, rates markets have spent the past few weeks treading water — sitting back and once again watching with envy the never-ending riches of equities.

Find out about

Pendal’s Income and Fixed Interest funds

About Tim Hext and Pendal’s Income and Fixed Interest boutique

Tim Hext is a portfolio manager with Pendal’s Income and Fixed Interest team.

Pendal’s Income and Fixed Interest boutique is one of the most experienced and well-regarded fixed income teams in Australia. In 2020 the team won the Australian Fixed Interest category in the Zenith awards.

With the goal of building the most defensive line of funds in Australia, the team oversees A$22 billion invested across income, composite, pure alpha, global and Australian government strategies.

Find out more about Pendal’s Income and Fixed Interest strategies here

About Pendal Group

Pendal is an independent, global investment management business focused on delivering superior investment returns for our clients through active management.

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at August 6, 2021. It is not to be published, or otherwise made available to any person other than the party to whom it is provided.

This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.

The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund.