Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Tim Hext: Are we becoming the Un-United States of Australia?

As State-based Covid strategies diverge we’re looking less and less like a federation. What does this mean for investors? Tim Hext explains in his weekly bond, income and defensive strategies note

IT’S been a rough ride for our federation during Covid.

Closed state borders, sniping among premiers and an us-versus-them mentality have overcome these usually united shores.

In normal times, State of Origin rugby league and the old Melbourne v Sydney debate (which I always think of as an “inside life” versus “outside life” debate) are fodder for mild banter.

But as State-based Covid strategies diverge, we seem less and less likely to be singing together: “I am, you are, we are Australian”.

NSW is going down the international route of learning to live with Covid. Other states are — to put it mildly — quite upset. National Cabinet today should be fiery.

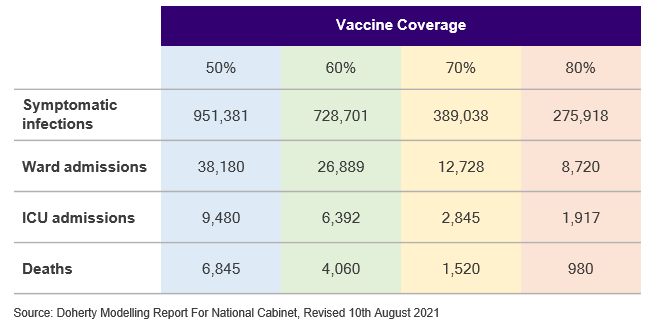

Modelling by the Doherty Institute, updated this week, suggests an “all adults” vaccination allocation strategy (rather than “older first”) looks like this table below.

“All adults” vaccination allocation strategy:

I will leave you to consider what are “acceptable” rates of infection, hospitalisations and deaths over a six-month period.

But it is the uneviable task of a politician to balance these outcomes with the economic and human welfare benefits of reopening.

For now NSW is on its own with incoming fire.

Other states, largely successful in curbing big breakouts of the Delta variant, remain committed to a suppression strategy for now.

Isolated states such as WA and Tasmania seem confident, while Victoria and Queensland are understandably nervous.

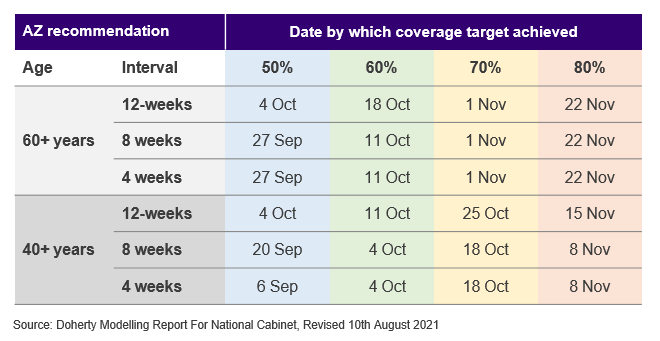

When would we hit these vaccination levels? The Doherty report shows this table below from a month ago. Hopefully recent efforts will see these dates brought forward.

Estimated completion dates for different vaccination rollout strategies (based on progress at July 12):

Welfare as a state responsibility

All this would matter less if welfare was a state responsibility.

Each state could go its own route — with even harder border closures — and reap the associated benefits and costs.

But we are a federation. Canberra controls money printing, social security and interntional borders.

It is likely to get very messy, very soon — further complicated by an upcoming election (latest 2022) where Queensland seats will likely determine the result. Good luck ScoMo!

The outlook

From a market point of view data and outcomes are moving every day, but few expect a full national opening before November or even December.

International border openings are now pushed back well into 2022.

Find out about

Pendal’s Income and Fixed Interest funds

We maintain the view that 2022 will bring a pick-up in wages and services inflation and the RBA will be tightening by 2023.

For risk markets, though, it will be more tailwinds. Inflation is unlikely to reach the kind of levels that tip market psychology into fear.

That level would be persistent inflation above 4%. For risk markets inflation at 2.5% and growth at 3% is almost the perfect mix — and likely to happen medium term.

Whether it’s plain sailing on the way is debatable. Uncertainty remains high but markets for now are alert not alarmed.

About Tim Hext and Pendal’s Bond, Income and Defensive Strategies (BIDS) boutique

Tim Hext is a portfolio manager with Pendal’s Bond, Income and Defensive Strategies (BIDS) team.

Pendal’s BIDS boutique is one of the most experienced and well-regarded fixed income teams in Australia. In 2020 the team won the Australian Fixed Interest category in the Zenith awards.

With the goal of building the most defensive line of funds in Australia, the team oversees A$22 billion invested across income, composite, pure alpha, global and Australian government strategies.

Find out more about Pendal’s fixed interest strategies here

About Pendal Group

Pendal is an independent, global investment management business focused on delivering superior investment returns for our clients through active management.