Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Rising energy prices bring ‘idiosyncratic risks’ for investors

Equities investors will see a continued impact from rising energies, but talk of a new energy crisis is overblown says Pendal’s Asian equities expert SAMIR MEHTA

RISING energy prices are posing an increasing threat to the global economic recovery, with very few businesses immune from the ripple effects of a higher oil and gas prices, according to Pendal portfolio manager Samir Mehta.

Mehta, who manages Pendal Asian Share Fund, says the effects of higher oil and gas prices mean lower disposable incomes across developing and developed markets — and will crimp business profits as the world emerges from Covid.

But talk of a new energy crisis is overblown, he says. The world is in a very different place from the last oil shock in 2008, with materially higher incomes and more accommodative policy to soften the direct blow to incomes.

“You also have to consider the time value of money. The last time the oil price went above $100 was 2008. A dollar does not have the same value today as it did in 2008.

“Headline prices have increased significantly this year, however in a historical context there are substantial differences.

“Global GDP has grown by roughly 3 to 4 per cent per annum over the past decade.

“Relative to GDP, energy prices are still benign compared to 2008.”

A headwind for economic recovery

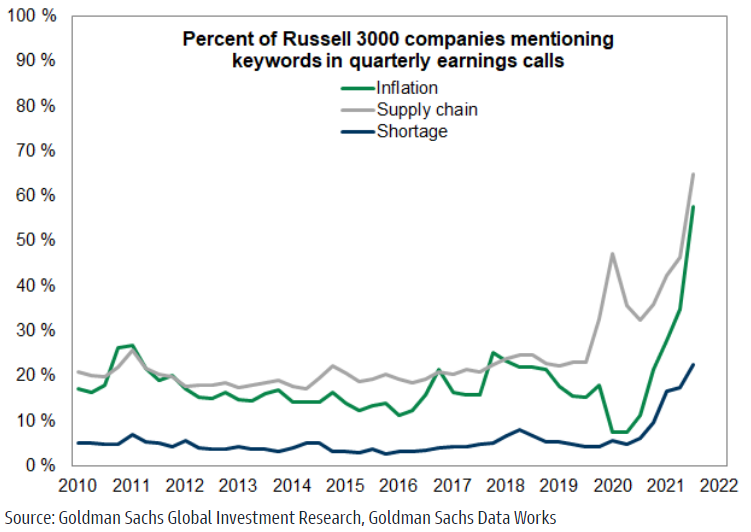

Still, rising energy prices are coming at a delicate time for global markets, which are also coping with a slowing Chinese economy, supply chain-related inflation and a gradual tapering in monetary policy stimulus as bond-buying programs shrink relative to the size of the economy.

Find out about

Pendal Asian Share Fund

“In India, petrol and diesel prices are above all-time highs,” says Mehta.

“Americans are starting to feel it at the pump. Australia and every other country are going to face the same problem.”

The underlying driver of higher energy prices is restrictions on supply due to underinvestment in energy infrastructure as the world grapples with carbon emissions reductions targets, says Mehta.

China recently ordered coal mines back to production after sweeping power cuts aimed at improving environmental outcomes.

China’s reaction to energy shortages is also likely to include limits on coal prices and coal company profits to push energy costs lower.

But this heavy-handed approach is likely to have unintended consequences, says Mehta.

“There is a clearing mechanism in capitalism called pricing which usually brings supply and demand into some kind of equilibrium.”

“Markets are telling us we need more supply. But as a society are we prepared to allow more coal or oil or gas production?”

China’s zeal for zero-COVID ahead of the Beijing Winter Olympics is also complicating the outlook, with ports, transport, cities and even whole provinces at risk of shutdowns if COVID cases emerge.

“They are the last hold-outs,” says Mehta. “Every other country except North Korea has given up on zero COVID – even Australia and New Zealand.”

Businesses face a conundrum

The result is that businesses — and investors — are faced with a difficult conundrum.

“I may own a business that has navigated supply chain problems, but all of sudden my customers might face lower disposable incomes,” says Mehta.

“Or I own a business in which disposable incomes are not a problem – the business has pricing power – but that business can’t meet demand due to lack of inputs as their suppliers are struggling.

“Purchasing managers at companies must be ‘over ordering’ to hedge their bets and build contingency reserves — this could mean an inventory build-up. Strong current demand might not necessarily mean end consumer demand. There are several issues to grapple with.”

Idiosyncratic investor risks

So, how can investors proceed through such an uncertain outlook?

Mehta advises a stock-by-stock and country-by-country approach but is still subject to risks.

“This is a situation in which few businesses – if any – will remain immune from the conditions we find ourselves in,” he says.

“Almost every single company in their result announcements mention rising costs.

“The intensity of uncertainty has increased.

“We are likely facing a very volatile period for markets with idiosyncratic risks – be prepared for it.”

About Samir Mehta and Pendal Asian Share Fund

Samir manages Penda’s Asian Share Fund, an actively managed portfolio of Asian shares excluding Japan and Australia. Samir is a senior fund manager at UK-based J O Hambro, which is part of Pendal Group.

Pendal Asian Share Fund aims to provide a return (before fees, costs and taxes) that exceeds the MSCI AC Asia ex Japan (Standard) Index (Net Dividends) in AUD over the medium-to-long term.

Find out about Pendal Asian Share Fund

About Pendal Group

Pendal is an independent, global investment management business focused on delivering superior investment returns for our clients through active management.

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at November 2, 2021.

PFSL is the responsible entity and issuer of units in the Pendal Asian Share Fund (Fund) ARSN: 087 593 468. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund and Trust are available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund.

An investment in the Fund or Trust or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested.

This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.

For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com